Why a Sector Hub Matters

If you’re buying within DHA City Karachi (DCK), sector choice significantly impacts daily life, build timelines, and resale ease. This hub distills street-level reality—not just map pins—so you can shortlist sectors fast, price them correctly, and walk on site with a bulletproof checklist.

How to use this page (Buy in DHA City Karachi)

- Scan the quick table below to pick a starting sector.

- Jump to the mini-guide for that sector (who it suits, what streets to prefer, watch-outs).

- Apply the pricing method (same-corridor comps) and run the 10-step checklist on site.

- DM us your budget + preferred pockets; we’ll WhatsApp today’s 5 best verified options.

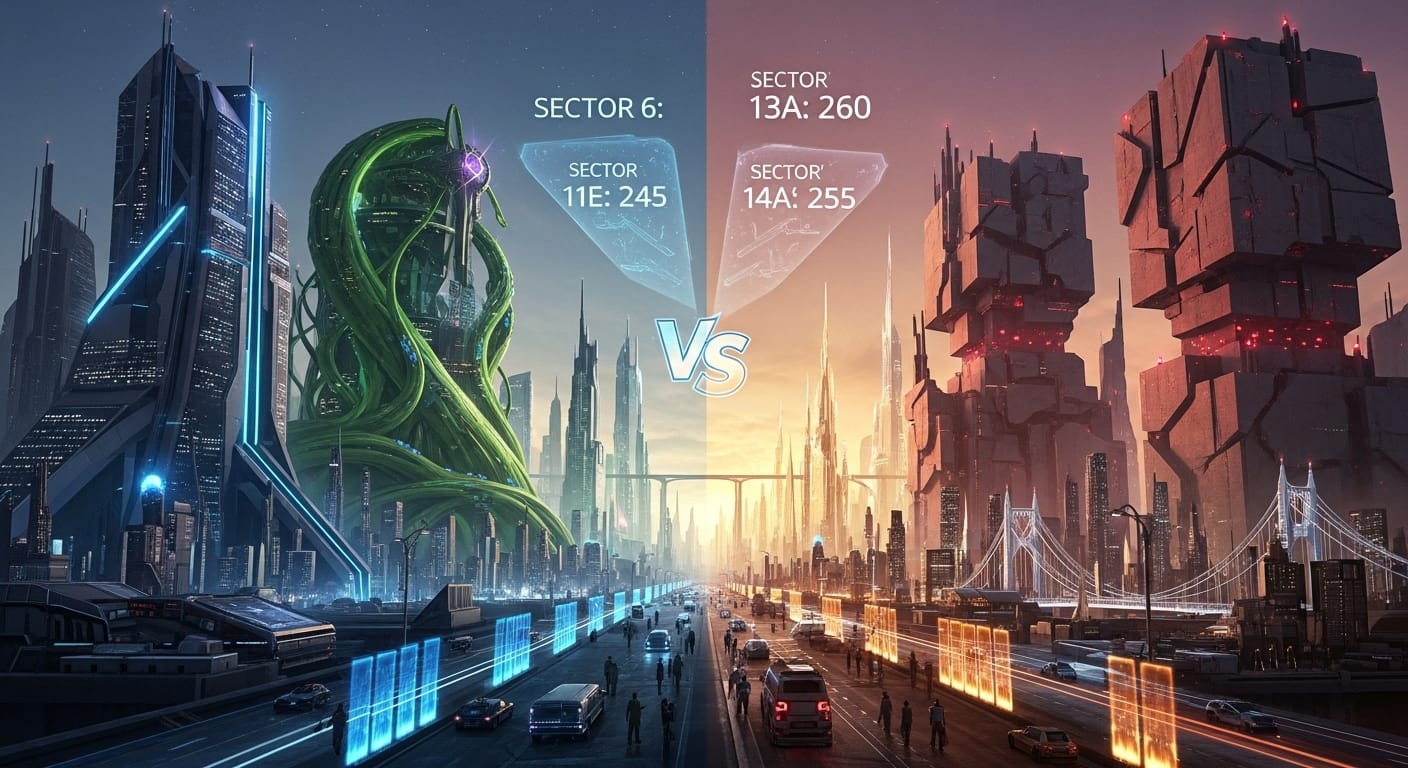

Quick Sector Snapshot (at a glance)

| Sector | Who it suits most | Access & feel | Livability vibe | Active sizes | Notes |

|---|---|---|---|---|---|

| 6 | Families & move-up buyers | Familiar grid, easy to navigate | Calmer backstreets, near parks/masjid/community | 200 • 300 • 500 • 1000 | Premium micro-pockets; tidy surroundings win |

| 11E | End-user + investor mix | Convenient with smart routing | Balanced; pocket quality varies by street | 200 • 300 | Compare sub-pockets carefully; insist on same-corridor comps |

| 13A | Value hunters | Improving approaches | Mixed finish; verify gradients & paving | 200 • 300 • 500 | Great negotiation angles when you price street-by-street |

| 14A | Entry & first homes | Practical from main | Growing community feel | 125 • 200 | Solid momentum for 125; check ROW & utilities in writing |

Start here: Sector 6 • Sector 11E • Sector 13A • Sector 14A

How to Read Sectors (and not get nudged)

- Backstreet > Avenue: Favor streets one–two turns off the main corridor. You keep access, lose noise and glare.

- ROW & Geometry: A simple SUV three-point-turn test tells you everything about car comfort and resale impressions.

- Orientation:

- West-open = breeze (manage heat with shading/landscape).

- Corner = light/parking (watch cut-through traffic).

- Park-facing = lifestyle/resale (check privacy, parking pressure, evening crowds).

- Topography: Stand at the lowest corner after a wash/rain; trace water flow. Fill/retaining math is a price lever.

- Surroundings: Pavements, signage, lighting and cleanliness matter—buyers feel this within seconds.

Mini-Guide: Sector 6 (Family Favorite)

Who should shortlist it: Families planning near-term builds on 200–500 yds, plus upgraders considering 1000 yds in select pockets.

What to like

- Familiar grid and calmer backstreets; parks/masjid close by.

- Regular listing flow → better liquidity for both end-use and upgrade paths.

Street cues to prefer

- Backstreet (1–2 turns off main), tested ROW/turning radius, west-open/corner/park-facing priced within the same street.

- Check grade/drainage; count under-construction neighbors (dust/noise horizon).

Sizes that work here

- 200 yds: 4–5 beds, strong buyer pool → faster exit.

- 300 yds: room for a study/den; wider frontage.

- 500 yds: villa-grade; basement only after soil check.

- 1000 yds: estate vibe in select pockets; verify utilities in writing.

Next reads:

200 yds • 300 yds • 500 yds • 1000 yds

Mini-Guide: Sector 11E (Balanced & Tradable)

Who should shortlist it: Buyers wanting a balanced end-use/investor play in 200–300 yds.

What to like

- Practical access if you route it smart; steady trading pockets.

Street cues to prefer

- Backstreet calm, park adjacency, working street lighting, clean edges.

- Price against same-corridor trades in the last 60–90 days—no cross-sector hearsay.

Watch-outs

- Micro-pocket quality varies; verify paving, signage and ROW.

- Token only after receipts/dues check out.

Mini-Guide: Sector 13A (Value Hunter’s Playground)

Who should shortlist it: Buyers with patience and pricing discipline for 200–300–500 yds.

What to like

- Street-by-street value if you price gradients, approach and finish correctly.

Street cues to prefer

- Backstreet one–two turns off the main; verify slope, drainage, and pocket finish.

- Corner/park/west-open premiums only within the same street hierarchy.

Watch-outs

- Don’t accept a “sector average.” Your exact corridor sets price.

Mini-Guide: Sector 14A (Entry Momentum)

Who should shortlist it: First-home families and investors targeting 125–200 yds.

What to like

- Momentum for 125 yds; practical day-to-day access.

Street cues to prefer

- Sufficient ROW for parking behavior, park-edge privacy at sunset, working lighting.

Watch-outs

- Token only with written utilities/possession status and receipts verified online.

Pricing Method That Actually Works

- Same-corridor comps (last 60–90 days) or it’s noise.

- Adjust inside the street for park/corner/west-open and for quirks (leveling, substation, cul-de-sac mouth).

- Ready-to-build pockets deserve higher asks but reduce holding/time risk. Developing pockets must pay you for time.

- Full-paid vs dues-remaining: price the true total—remaining dues, any penalties, your time value, extra admin trips.

Installments & Payment Hygiene

- Prefer published, recognized plans when available; keep every rupee on official rails (online payments + verification).

- Private installment pitches: normalize against an official table (down payment %, cadence, total ticket).

- If you want to build soon, a full-paid or clean dues-remaining in a ready pocket is usually simpler (and often cheaper overall).

Transfer & Timelines (High-Level)

- Typical sequence: documents scrutiny → biometric/sign-before → fee payment → NOC → final transfer.

- Clean files move faster; keep duplicate IDs/receipts and staple a map extract with pegs to your file.

- Token must state refund triggers, cheque numbers, transfer window, and who pays which fees.

Field-Tested 10-Step Buyer Checklist (Print This)

- Backstreet: one–two turns off the main corridor.

- ROW & Turn: SUV three-point-turn test; gate swing vs sliding feasibility.

- Orientation: west-open breeze, corner light/parking, park-facing lifestyle—price within same street.

- Topography: lowest corner water path; fill/retaining math = negotiation lever.

- Surroundings: paving, signage, lighting, cleanliness, vigilance presence.

- Under-construction load: dust/noise horizon if many neighbors are building.

- Paper chain: allotment/transfer history + seller CNIC copies.

- Receipts: dues/utility receipts verified online before token (screenshots ≠ documents).

- Utilities & possession: written status & timelines.

- Comps: 3–5 same-corridor trades (60–90 days); adjust for your plot’s quirks.

Common Mistakes (and how to dodge them)

- Pricing off cross-sector averages—you’ll either overpay or miss deals.

- Choosing avenue-front for “prestige” and living with noise/egress pain.

- Paying a park-facing premium without checking privacy, evening crowds, and headlight glare.

- Tokening on WhatsApp screenshots—verify on official portals first.

- Under-budgeting MEP & climate design to splurge on façade drama (comfort > cosmetics).

- Skipping the sunset visit—wind/light/traffic feel different in the evening.

CTAs & Internal Links (lock conversions)

- Talk to the DHA City Desk ApnaDHA

Tell us budget + preferred pockets; we’ll send today’s 5 best paper-verified options with quick video walk-throughs.

Sizes:

125 • 200 • 300 • 500 • 1000 • 2000

Sectors:

Sector 6 • Sector 11E • Sector 13A • Sector 14A

Market & Paperwork:

Latest Prices • Payment Plans • Transfer & Fees

FAQs

Q1. Which sector is best for families who want to build soon?

Sector 6 is an easy shortlist: familiar grid, calmer backstreets, and recurring inventory in 200–500 yds.

Q2. I’m on a tighter budget—where do I start?

Sector 14A for 125–200 yds. Check street width (ROW), lighting, and utilities in writing before token.

Q3. Park-facing, corner, or west-open—what’s best?

Depends on your street and lifestyle: park-facing for family use, corner for light/parking, west-open for breeze. Always price within the same street hierarchy.

Q4. Ready-to-build vs developing pocket?

Ready pockets cost more but reduce holding/time risk. Developing pockets can be value if you price risk properly and can hold.

Q5. How do I avoid overpaying?

Price against 3–5 same-corridor trades from the last 60–90 days and adjust for your plot’s specific quirks.

Join The Discussion