Why 300 Yards Plots in DHA Karachi? (The market’s “velocity” size)

In DHA Karachi, 300 yards is the size class where end-users and builders intersect: big enough for a genuine luxury home (4–5 beds, basement optional), but compact enough to build fast, sell fast, and stay liquid. It’s also the easiest on carrying costs, approvals, and construction sequencing compared to estate sizes.

In 2025, the strongest 300-yard demand clusters are:

- Phase 4 — premium, developed, close to everything (higher baseline ticket).

- Phase 7 / 7 Extension — value entry and rapid resale.

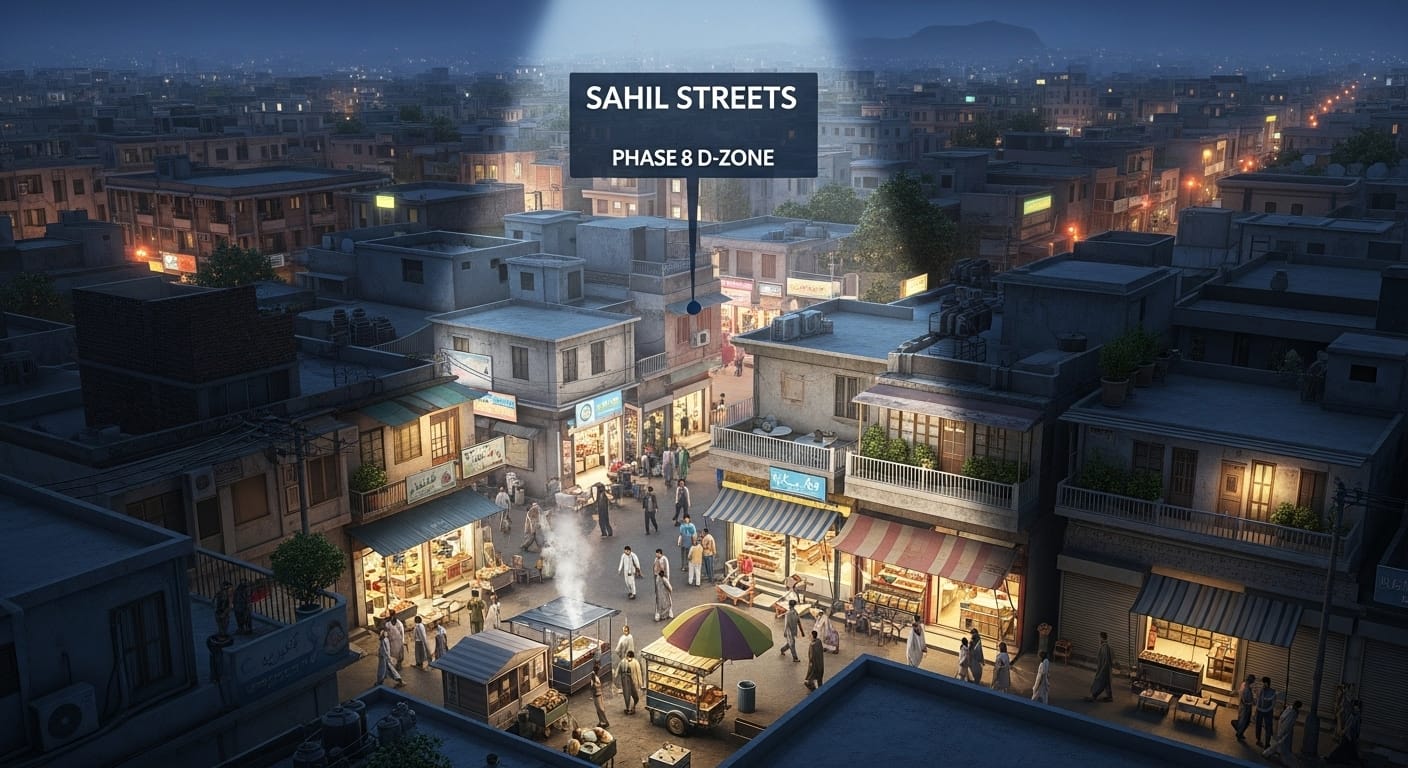

- Phase 8 D-Zone (Sahil Streets) — our spotlight: coastal-adjacent grid with strong builder turnover and aspirational buyer pull.

Snapshot (TL;DR)

- 2025 land bands (typical asks):

- Phase 4: ~₨ 7.5–11.5 Cr (orientation & lane tier drive spread)

- Phase 7 / 7 Ext.: ~₨ 4.8–7.5 Cr (fastest velocity; value plays)

- Phase 8 D-Zone (Sahil): ~₨ 6.5–9.5 Cr internal lanes; 7.5–10.5+ Cr west-open/park-facing/corner

- Construction (luxury spec 2025): ₨ 7,000–9,000/sq ft

- Buyer profile: families upgrading from 200 yd, overseas returnees, builders targeting 8–14-month flips

- Street rule: price within the same street hierarchy (corner on a quiet cul-de-sac ≠ corner on a cut-through)

Micro-Locations (with a spotlight on Sahil Streets, Phase 8 D-Zone)

Phase 4 (premium core)

- 40′ residential ROWs, walkable to commercial belts.

- West-open & park-facing fetch consistent premiums.

- Liquidity is high, but baseline ticket is higher than 7/7-Ext.

Phase 7 / 7 Extension (value + velocity)

- Compact lanes, highly active builder scene.

- Best for budget-controlled builds with quick resale.

- Great for first-time DHA plot owners stepping up from 200 yards.

Phase 8 D-Zone — SAHIL STREETS (Spotlight)

- Why Sahil? Close to the Seaview belt yet tucked into quiet residential backstreets. Street grid favors clean setbacks, usable front lawns, and proper porch geometry.

- Street reality:

- 40′ lanes preferred (SUV turning test passes comfortably).

- West-open catches evening sea breeze (design shading still required).

- Park-facing is prized but audit evening crowd/parking pressure.

- What sells fastest: Neat internal lanes 1–2 turns off the main boulevard; west-open with tidy frontage; no edge risks (not nala-adjacent).

- Who buys: End-users upgrading from smaller plots; builders who know how to stage basements/pools only when soil data supports it.

- Why it’s a builder favorite: Balanced ticket size, attractive end-user rent/sale bands, and consistent finish expectations (contemporary elevations, dual kitchens, one guest suite down).

2025 Price Bands & Liquidity

| Area / Attribute | Typical 2025 Ask (₨ Crore) | Liquidity Note |

|---|---|---|

| Phase 4 – internal lane | 6.5 – 7.0 | High (developed & central) |

| Phase 4 – west-open / park-facing | 6.0 – 7.5 | Very High (street-tier rules apply) |

| Phase 7 / 7 Ext. – internal | 4.8 – 6.5 | Very High (value/velocity) |

| Phase 7 / 7 Ext. – corner/park/west | 4.0 – 6.5 | High |

| Phase 8 D-Zone (Sahil) – internal | 4. – 5.5 | High |

| Phase 8 D-Zone (Sahil) – west/park/corner | 5 – 6+ | High (aspirational pull) |

Pricing discipline: Always benchmark 3–5 same-corridor trades (last 60–90 days) on your target street before token. Evidence > anecdotes.

Builder Activity & ROI — SAHIL STREETS (Phase 8 D-Zone)

Assumptions: 300-yd plot, modern elevation, ~5,200–5,800 sq ft covered, luxury spec, no pool/basement in Base; Mid/High scenarios may add one.

A) 2023 → 2025 ROI Trend (Illustrative, street-tier dependent)

| Year | Land (Cr) | Build (Cr) | Soft + Carry (Cr) | All-in (Cr) | Typical Sale (Cr) | Gross Margin |

|---|---|---|---|---|---|---|

| 2023 | 5.5 | 3.8 | 0.3 | 10.6 | 12.2 | ~15% |

| 2024 | 6. | 4.2 | 0.4 | 11.8 | 13.7 | ~16% |

| 2025 | 7.5 | 4.6 | 0.5 | 13.1 | 15.2 | ~16% |

What drives the spread:

- Street tier (internal vs cut-through vs park-edge)

- Orientation (west-open premium when shaded correctly)

- Spec discipline (luxury where buyers feel it: kitchens, baths, HVAC, joinery)

- Time-to-market (8–12 months ≠ 16–18 months)

Pro tip: Don’t overbuild façade at the expense of MEP (mechanical/electrical/plumbing). Buyers feel comfort; they see elevation.

Construction Cost Matrix (300 yards, 2025)

| Spec Level | ₨/sq ft (2025) | Typical Covered Area | Build Cost | What’s Included |

|---|---|---|---|---|

| Luxury-Base | 7,000 | 5,200 sq ft | 3.64 Cr | Quality fenestration, inverter AC wiring, good tile/fixtures, modular kitchen |

| Luxury-Mid | 8,000 | 5,600 sq ft | 4.48 Cr | Better glazing, premium kitchens & baths, partial automation, improved insulation |

| Luxury-High | 9,000 | 5,800 sq ft | 5.22 Cr | Advanced HVAC/VRF, high-end joinery, smart home, select stone cladding |

| Add-ons | Basement (add ~0.7–1.0 Cr) • Pool (add ~0.5–0.8 Cr) • Elevator (~0.35–0.5 Cr) |

Guardrails: Get a soil report before committing to basement/pool in Sahil. Detail waterproofing and drainage at concept stage.

Program & Planning (What 300 yards unlocks)

- Ground Floor (guests + daily life): foyer → drawing/dining (sound-separated), guest suite with vestibule, family lounge + open kitchen to a covered veranda and lawn.

- First Floor (family privacy): 3–4 beds + pajama lounge, terrace with pergola & screen for west sun.

- Service Circulation: show kitchen + dirty kitchen with pantry; discreet staff/service access to utility yard & refuse point.

- Roof: solar/inverter zone + shaded seating; plan parapet drainage (monsoon).

- Basement (case-by-case): theatre + gym; design acoustics, fresh-air make-up, and redundant sump/power.

Official Artifacts & Transfer (Non-negotiable)

- Maps: Download sector/phase maps; print the extract; mark pegs.

- Online Verification: Cross-check ownership & dues against CNIC/File No before token.

- Transfer: Urgent (same-day) possible for clean files; otherwise ~1–2 weeks (scrutiny → biometric/sign-before → fees → NOC → transfer).

- Money Rails: Pay order/bank transfers only. Screenshots ≠ protection.

- Cost Buffer: Budget ~4–5% of price (transfer fee + stamp + CVT + advance tax + membership if applicable).

External links:

- DHA Karachi (maps, forms, fees): dhakarachi.org

- Plot/Payment Verification: olps.dhakarachi.org.pk

- CBC by-laws/water: cbc.gov.pk

Field-Tested 14-Point Due-Diligence (Sahil-ready)

- Street hierarchy — 1–2 turns off boulevard (not main road, not too deep).

- ROW & geometry — 40′+ preferred; test SUV ingress/egress.

- Frontage & setbacks — balance elevation massing vs usable lawn.

- Orientation — west-open premium (design for shade and ventilation).

- Topography — avoid depressed pockets; trace rainwater path.

- Soil & water table — basement/pool only after report.

- Surroundings — lights, pavements, cleanliness; count active builds.

- Edge risks — avoid nala-adjacent or boundary edges unless engineered.

- Paper chain — allotment/transfer history, seller CNIC, receipts.

- Portal check — verify online before token.

- Utilities — get written status/timeline.

- Comps — 3–5 same-lane trades (60–90 days).

- Token terms — refund triggers, transfer window, fee responsibilities.

- Second visit — sunset check for headlights, traffic, evening crowds.

10 Buyer/Builder Mistakes (and how to dodge them)

- Cross-phase pricing — pricing Sahil off Phase 6 anecdotes. Use Sahil comps.

- Avenue prestige trap — main-road glare/noise hurts resale. Pick backstreets.

- Basement without soil data — future seepage. Test first, detail waterproofing.

- Façade over MEP — comfort sells; skimping HVAC/plumbing backfires.

- Token on screenshots — verify on DHA portal first.

- No service corridor — day-to-day operations suffer.

- Park-facing without reality check — evening crowd/parking patterns.

- Corner mispricing — corner on a cut-through ≠ corner on cul-de-sac.

- Under-budgeting transfer/taxes — keep ~5% buffer.

- Stretching spec beyond cap — don’t overshoot local ceiling sale price.

Budget Sanity (Worked Example — Sahil Internal Lane)

- Land (ask): ₨ 8.5 Cr

- Build (Luxury-Mid, 5,600 sq ft × ₨ 8,000): ₨ 4.48 Cr

- Soft (design, approvals, utilities): ₨ 0.45 Cr

- Contingency (10% of build): ₨ 0.45 Cr

- Transfer/Taxes (~4.5% of land): ₨ 0.38 Cr

Total Project Outlay: ~₨ 14.26 Cr

Exit thinking: Local ceiling for a non-basement luxury-mid in Sahil internal lanes typically sits around ₨ 14.5–15.5 Cr (street-tier dependent). Keep specs targeted: kitchens/baths/MEP first, façade second.

300 vs 500 yards — Which makes more sense in 2025?

| Attribute | 300 yds | 500 yds |

|---|---|---|

| Typical Land (2025) | ₨ 5–11 Cr (area-dependent) | ₨ 7–12 Cr (Phase 6) |

| Build Cost (lux) | Lower absolute (₨ 3.6–5.2 Cr) | Higher absolute (₨ 5.5–7.5 Cr) |

| Time to Build | 8–14 months | 14–18 months |

| Buyer Pool | Broad (first-time luxury, upgraders, builders) | Broad (family benchmark), pricier ticket |

| Liquidity | Very High | High |

| Use-case | ROI flips / mid-luxury end-use | Larger family homes / long-term end-use |

Call: If you’re optimizing for speed + ROI, 300 yds (especially Sahil Streets) is your 2025 engine. If you want bigger family canvas, move to 500 yds.

FAQs (AEO-style)

Q1. Are 300-yard Sahil plots good for flipping?

Yes — balanced ticket size, strong end-user pull, and builder-standard specs make Sahil a consistent 8–14-month flip zone (street-tier dependent).

Q2. West-open vs park-facing — which wins?

Depends on street reality. West-open gets breeze (design shading). Park-facing sells on openness but audit evening crowd/parking first.

Q3. Basement on 300 yds — sensible?

Case-by-case. In Sahil, commission soil + water table tests first; if green-lit, design waterproofing + ventilation from Day 0.

Q4. Typical construction cost in 2025?

Luxury builds: ₨ 7,000–9,000/sq ft (finishes, glazing, HVAC drive variance).

Q5. How do I verify the plot before token?

Use DHA’s online verification for ownership/dues and match to seller CNIC/file. No screenshot deals.

Q6. Transfer time?

Urgent same-day possible on clean files; routine ~1–2 weeks.

Q7. “Corner” always worth it?

Only if quiet lane geometry works (parking, sightlines). Corners on cut-throughs can be a headache.

Q8. Which micro-location is best for budget?

Phase 7 / 7 Ext. gives the lowest ticket with rapid resale. Sahil is pricier but aspirational.

Q9. Where do I spend for best resale feel?

Kitchens, baths, HVAC/insulation, joinery. Elevation matters, but comfort sells the home.

Q10. What if my budget can’t handle Phase 6/Sahil?

Start in 7 Extension with a clean internal lane; build a crisp, efficient plan and scale up later.

🔗 Internal Links — Keep Exploring

By Size

- 200 Yards Plots in DHA Karachi

- 300 Yards (You’re Here)

- 500 Yards in Phase 6 — 2025 Guide

- 666 Yards in Phase 8 — 2025 Guide

- 1000 Yards in Phase 5 — 2025 Guide

Market / Process

- DHA Karachi Plots — Pillar (2025)

- Transfer Fees & Process

- Construction Costs 2025

- Ground + 5 Policy Explained

🌐 External Links (Official)

- DHA Karachi: dhakarachi.org

- Plot/Payment Verification: olps.dhakarachi.org.pk

- CBC (By-laws/Water): cbc.gov.pk

📲 Talk to the Phase 8 / Sahil Desk (ApnaDHA)

Want today’s best paper-verified 300-yard Sahil plots (Phase 8 D-Zone) with quick walk-through videos and same-street comps?

WhatsApp: 0300-8277717 • Website: ApnaDHA.com

Join The Discussion