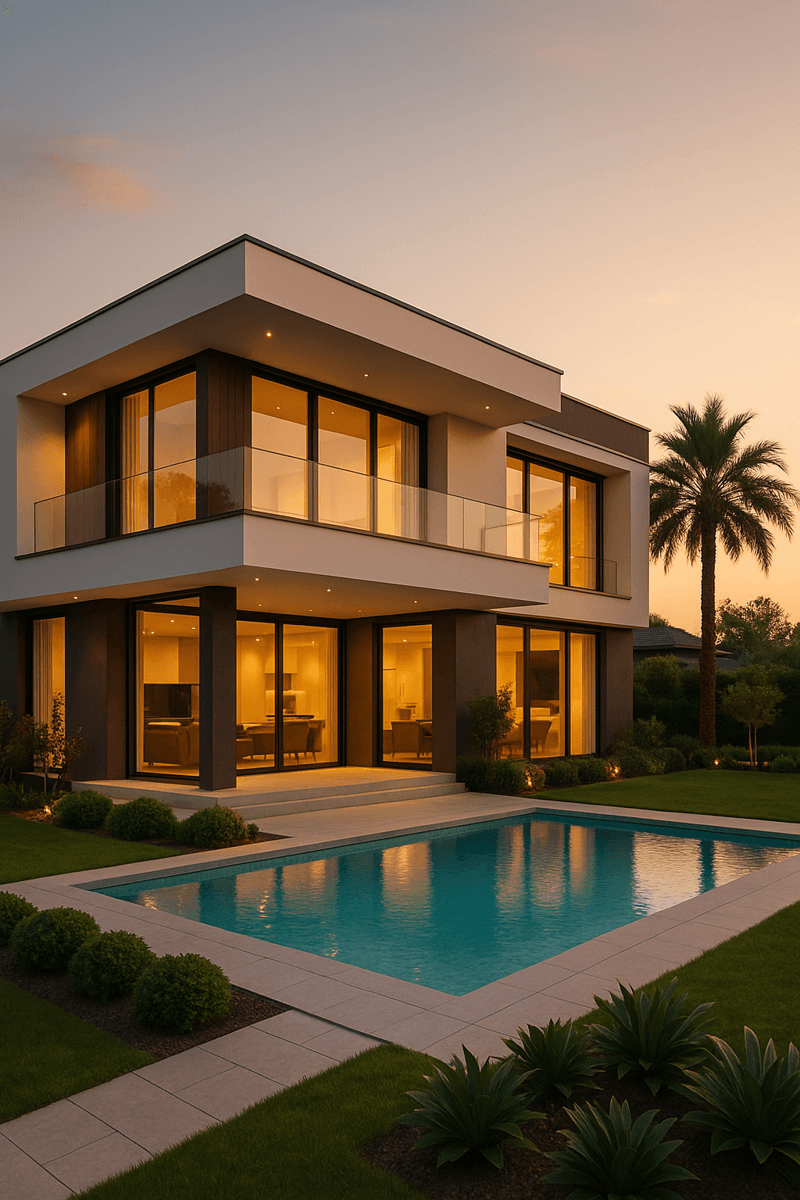

Investors looking for high‑end real estate opportunities in Pakistan often turn to Defence Housing Authority (DHA) developments because of their superior infrastructure, secure environment and strong rental demand. DHA Karachi is especially attractive: its house prices have historically outperformed the broader market and continue to show steady appreciation1. This comprehensive guide explores why DHA Karachi remains a prime investment destination in 2025, examines price trends by plot size and phase, identifies the top hotspots and outlines strategies to maximize returns.

1. Market Overview: Best Investment in DHA Karachi Property 2025

Average house prices and growth

According to the Zameen Property Index, the average price of a house in DHA Karachi stood at around PKR 17.57 crore in June 2025, reflecting a price increase of roughly 4 % over the last six months and 5 % compared with the previous year2. Such steady, moderate growth highlights DHA Karachi’s resilience even amid broader economic fluctuations.

Price trends by plot size

Property sizes are typically expressed in square yards in Karachi. Larger plots tend to appreciate faster, but smaller plots can yield higher relative returns. 2025 data show the following average prices and growth rates across common plot sizes3:

| Plot Size (sq yds) | Average Price (PKR) | 6‑Month Change | 1‑Year Change | Notes |

|---|---|---|---|---|

| 500 yards (≈1 Kanal) | ≈14.69 crore | +3 % | +4 % | Popular for family homes and high‑end villas |

| 1000 yards (≈2 Kanal) | ≈24.89 crore | +2 % | +3 % | Luxury properties; fewer listings, strong capital growth |

| 250 yards (≈10 Marla) | ≈6.74 crore | +4 % | +5 % | Mid‑range buyers; good rental demand |

| 125 yards (≈5 Marla) | ≈4.78 crore | +5 % | +6 % | Affordable entry; often targeted by investors flipping properties |

These figures highlight the price trends by plot size in 2025 and underline that even smaller plots in DHA Karachi command premium prices because of the community’s brand and amenities3.

2. Phase‑Wise Investment Opportunities

Prices and growth rates vary across different phases of DHA Karachi. Investors should consider not only current prices but also each phase’s future potential.

- Phase 8 – The most expensive and sought‑after phase, with average house prices around PKR 23.85 crore and an 11 % year‑on‑year increase4. It offers waterfront views, modern infrastructure and proximity to DHA Golf Club. Phase 8’s commercial zones and luxury apartments (e.g., Creek Vista and Marina) attract investors seeking premium rental yields5.

- Phase 6 – Averaging PKR 16.25 crore, Phase 6 recorded a 5 % annual growth4. Its central location and established commercial areas make it attractive for both residences and retail.

- Phase 5 – With average prices around PKR 15.52 crore, Phase 5 offers stable growth of about 4 %4. It is valued for its schools and parks.

- Phase 7 Extension – This phase shows 9 % annual growth, with average prices around PKR 10.68 crore4. Its comparatively lower entry price and upcoming developments present excellent upside potential.

- Phases 1–4 & Phase 2 Extension – These older phases offer more affordable options (prices ranging from PKR 2.93 crore to 9 crore) yet still deliver respectable growth6. They attract middle‑class buyers and investors seeking rental income.

3. Top Investment Hotspots for 2025

While each phase has its merits, certain pockets within DHA Karachi are regarded as top investment destinations because they combine high capital appreciation with steady rental demand:

- Creek Vista & Creek Marina (Phase 8) – Luxury apartment complexes overlooking the sea. 500 sq‑yd plots here command PKR 80–130 million, while apartments sell for PKR 50–90 million7. The prestige and amenities make these developments ideal for investors targeting affluent tenants.

- Phase 8 Commercial Zone – A hub for offices and retail that yields strong rental returns. Investors can secure long‑term commercial leases and benefit from Phase 8’s status as an investor’s paradise5.

- Zulfiqar Street – Known for high‑end houses and its proximity to the sea. Demand from expatriates and business executives keeps prices buoyant.

- Phase 7 Extension – Offers lower entry prices yet proximity to Phase 8, making it a strategic choice for investors looking for capital growth without the Phase 8 premium.

4. Impact of New Developments & Infrastructure

Investment decisions should factor in upcoming projects and infrastructure upgrades:

- DHA City Indus Hills & other installment‑plan projects – New developments located off the Super Highway offer plot purchase on installments. Analysts note that these projects have caused a temporary market correction in DHA Karachi, creating buying opportunities8.

- Malir Expressway – This under‑construction 38 km expressway will connect DHA to Karachi’s eastern districts. Completion is expected by late 2026; once operational, it will reduce travel times and is projected to boost property values along the corridor9.

- Commercial & infrastructure upgrades – Ongoing improvements, such as new hospitals, schools and retail centers within Phases 6–8, continue to enhance livability and drive demand.

5. Investment Strategies & Risk Considerations

Choosing between residential and commercial investments

- Residential properties (houses and apartments) offer steady capital appreciation and can deliver high rental yields, particularly in upscale areas like Phase 81. They are suitable for investors looking for long‑term value and easier resale.

- Commercial properties (shops, offices, plots in business districts) provide higher rental yields but require larger capital outlays and involve longer vacancy periods. In Phase 8’s commercial zone, demand from banks, boutiques and restaurants makes this segment attractive.

Plot size & budget considerations

- 250–500 sq‑yd plots suit mid‑range investors seeking a balance between affordability and appreciation.

- 500–1000 sq‑yd plots cater to high‑net‑worth individuals and deliver stronger capital gains but tie up more capital.

Managing risks

- Market timing – Price corrections following new project launches can offer buying opportunities; however, overpaying during peaks can compress returns8.

- Infrastructure delays – Major roads or public projects may face delays; factor in contingencies when forecasting returns.

- Legality & documentation – Always verify plot documentation with DHA authorities and work with reputable agents.

6. Frequently Asked Questions (Best investment in DHA Karachi Property 2025)

Why is DHA Karachi considered a good investment in 2025?

DHA Karachi combines premium infrastructure, strict building regulations and high security, making it one of Pakistan’s most sought‑after communities. Its house prices show steady year‑over‑year growth (4–5 % in 2025)2, while rental demand and yields remain strong due to the influx of professionals and expatriates1.

Which phase offers the best returns for investors?

Phase 8 currently commands the highest prices and experiences the strongest appreciation (11 % annual growth)4. It hosts luxury apartments and commercial hubs like Creek Vista and Creek Marina, attracting high‑end tenants and investors5. However, Phase 7 Extension offers excellent upside due to its lower entry price and proximity to Phase 84.

Is it better to invest in residential or commercial property?

It depends on your goals. Residential properties in DHA Karachi provide solid long‑term appreciation and are easier to sell. Commercial properties can yield higher annual rents but require larger investments and can face longer vacancy periods. Diversifying across both can help balance risk and return.

How will the Malir Expressway affect property prices?

The Malir Expressway will significantly improve accessibility between DHA Karachi and other parts of the city. Experts expect this connectivity boost to increase property values once the project nears completion9. Investors who purchase before the expressway becomes operational may benefit from capital gains.

Are there any affordable investment options in DHA Karachi?

Yes. Phases 1–4 and Phase 2 Extension offer more affordable homes and plots (between PKR 2.93 crore and 9 crore), while still delivering solid growth6. Smaller plots (125–250 sq yds) in these phases provide a lower entry point for investors.

What risks should I be aware of?

Potential risks include market corrections following new project launches8, delays in infrastructure projects, and regulatory changes. To mitigate these risks, conduct thorough due diligence, stay updated on market news and work with registered real‑estate agents.

Conclusion

DHA Karachi’s real estate market remains one of Pakistan’s most promising investment avenues in 2025. Strong fundamentals—steady price appreciation, high rental demand and premium infrastructure—make it attractive to both local and overseas investors1. By analysing price trends, understanding phase‑wise opportunities and accounting for upcoming developments like the Malir Expressway, investors can make well‑timed decisions that maximise returns. Whether you’re targeting luxury apartments in Phase 8 or seeking affordable plots in older phases, DHA Karachi offers a range of options to fit different budgets and strategies.

Ready to invest in DHA Karachi?

Discover the most promising listings and get personalized advice from our experienced real‑estate consultants. Visit ApnaDHA.com to explore properties tailored to your budget, or contact us today to schedule a consultation and start your investment journey.

For more detailed insights, explore our related articles on phase‑specific investment guides, rental yield analyses and property financing options.

References for the best investment in DHA Karachi Property 2025

Footnotes

- Reasons why investors choose DHA, including premium living, consistent appreciation and high rental yieldsalmunirproperty.com. ↩ ↩2 ↩3 ↩4

- Average house price in DHA Karachi (PKR 17.57 crore in June 2025) and percentage growth in 6 months and 1 yearzameen.com. ↩ ↩2

- Data on average prices and growth rates by plot size (500, 1000, 250 and 125 sq yards)zameen.com. ↩ ↩2

- Phase‑wise price levels and growth rates for Phases 8, 6, 5 and 7 Extensionzameen.com. ↩ ↩2 ↩3 ↩4 ↩5 ↩6

- Statement that Phase 8 is considered an investor’s paradise with premium rental yieldsalmunirproperty.com. ↩ ↩2 ↩3

- Price ranges and growth for Phases 1–4 and Phase 2 Extensionzameen.com. ↩ ↩2

- Price ranges for Creek Vista and Creek Marina apartments and plotsalmunirproperty.com. ↩

- Discussion of new projects like DHA City Indus Hills causing temporary market corrections and opportunities for buyerspropertypole.com. ↩ ↩2 ↩3

- Information on the Malir Expressway construction timeline and its expected impact on property valuespropertypole.com. ↩ ↩2

Join The Discussion