If your brief is simple—“find value without compromising daily livability”—DHA City Karachi Sector 13A | Value Streets & Tips should be on your short list. It’s known for street-by-street opportunities: some pockets feel almost “ready,” others still look mid-transition. That variability is exactly why disciplined buyers win here. Work with micro-location, approach quality, and gradient/topography—and price strictly off same-corridor comps (last 60–90 days). Do that, and 13A turns into a high-signal hunting ground for 200, 300, and 500 yards.

Quick who-it-suits

- End-users seeking 200–300 yds with near-term build plans (but willing to verify utilities/possession in writing).

- Upgraders out of 125/200 who want 300 yds breathing room without the 500-yd jump in carry.

- Investors who understand street selection and negotiation levers (leveling, approach, surroundings).

How Sector 13A “works” (mindset to bring)

Think of 13A as micro-markets separated by short turns and slight level changes. Two streets 200 meters apart can price differently. Your job is to narrow from sector → pocket → street → frontage and keep notes. When the map looks identical, the approach feel, ROW/turning, evening lighting, and neighbor build-load reveal the truth.

Access & movement (practical touring plan)

- Cluster your visits: pick 2–3 adjacent streets per session—avoid zig-zagging across the sector.

- Visit twice: mid-day for heat/traffic realism, sunset for wind, glare, and park-edge behavior.

- Time your turns: a street that’s one extra turn off the main may be quieter, safer, and better for resale.

- Log it: keep a simple note per street—turning radius, ROW comfort, headlight glare, construction noise, cleanliness.

Street-Selection Method (13A edition)

1) Backstreet > Avenue

Avenues look “grand” but often come with noise, glare and cut-through speed. In 13A, one–two turns off the main corridor usually strikes the best balance: access without headache.

2) ROW & turning geometry

Do the SUV three-point-turn test. Record:

- Turning comfort, gate swing vs sliding feasibility

- Porch depth (1 big SUV or 1 SUV + 1 compact?)

- Corner radii and cul-de-sac mouths (bonus or bottleneck?)

3) Orientation & premiums (priced inside the same street)

- West-open: catches breeze—counter heat with shading, glazing specs, and landscape.

- Corner: extra light/parking—watch for cut-through traffic.

- Park-facing: lifestyle/resale appeal—check evening parking pressure, kids’ play, and headlight glare.

Pay any premium only after comparing within the same street hierarchy—not across the sector.

4) Topography & drainage (your quiet superpower)

Stand at the lowest corner after a wash/rain; trace the water path. If the plot needs fill/compaction, quantify it and fold into price. Gentle slope away from your porch is comfort; ponding near your boundary is leverage.

5) Surroundings & “pocket finish”

Look for paved edges, signage, working streetlights, cleanliness, vigilance presence. Count active builds—dust/noise horizons matter if you plan to live or rent soon.

6) Utilities & possession (in writing)

Verbal promises don’t count. Ask for dated letters/emails on utilities/possession. Photograph documents; keep duplicates. Verification protects your token and your exit.

What sizes make sense in 13A (and how to plan)

200 yards (liquid & liveable)

- Why: largest buyer pool; simpler construction budgets; quick to rent or resell when papers/utility status are clean.

- Plan ideas: porch (1 car), drawing/powder up front, open kitchen + family lounge, 1 ground-floor bed; upstairs 3 beds + terrace.

- Design notes: deeper overhangs, cross-vent windows; pre-run conduits for solar/inverter + EV.

300 yards (move-up comfort)

- Why: better frontage + parking geometry; real study/home office; flexible family zoning.

- Plan ideas: 2-car comfort (or 1 SUV + 1 compact), show + service kitchen option, guest suite ground, shaded terrace above.

- Design notes: keep shafts stacked; align stair core to accept a compact lift later.

500 yards (select pockets)

- Why: villa-grade footprint with elevation presence. Best when pocket feels “ready” or clearly trending.

- Plan ideas: formal suite + family core, show + service kitchen, optional gym/office; basement only after soil/water-table investigation.

- Design notes: service circulation (staff/utility) separate from formal areas; acoustic/thermal comfort first, façade drama later.

Pricing Discipline (avoid the nudge)

- Same-corridor comps (60–90 days)

Demand 3–5 trades from the exact corridor—not a sector average. Adjust for your plot’s specifics (corner/park/west-open, cul-de-sac mouth, transformer adjacency, boundary clarity). - Ready vs developing pockets

Ready pockets deserve higher asks but de-risk your timeline. Developing pockets must pay you for time risk (carry, uncertainty, admin friction). Discount accordingly. - Full-paid vs dues-remaining

Compute the true total: remaining dues + any penalties + your time value + number of admin trips. A “cheap” ask isn’t cheap if the carry eats your saving. - Leveling & approach math

Quantify fill/compaction, curb cuts, and porch/gate adjustments. These are credible negotiation levers—especially in value streets. - Evening reality check

If park-edge glow blinds your porch or cut-through rush peaks at sunset, price that pain or walk away.

Negotiation Levers That Actually Work in 13A

- Fill/compaction requirement (quote from contractor = price chip).

- Approach quality (one extra turn off a busy spine = quieter living; use it to explain your offer).

- Neighbor build-load (months of dust/noise ahead? discount or escrow for cleaning/mitigation).

- Boundary clarity & pegs (map extract + pegs marked = confidence; mismatch = reason to revise).

- Receipts & acknowledgements (anything unclear on verification? pause token or renegotiate).

Installments & payment hygiene (simple rules)

- Prefer published/recognized plans where available; always pay through official rails so acknowledgements show up in verification.

- For ready pockets, full-paid or clean dues-remaining is usually simpler—especially if you want to break ground soon.

- Private “installment” pitches are fine to hear, but normalize against a recognized table (down-payment %, cadence, total ticket) and keep proof flows verifiable.

Build-Now vs Hold-Then-Build (which path wins here?)

- Build-now suits ready or nearly ready pockets; you lock value via livability and get ahead of later price steps.

- Hold-then-build suits buyers with a patient horizon who secure a real discount in developing pockets—document utility timelines and carry cost assumptions.

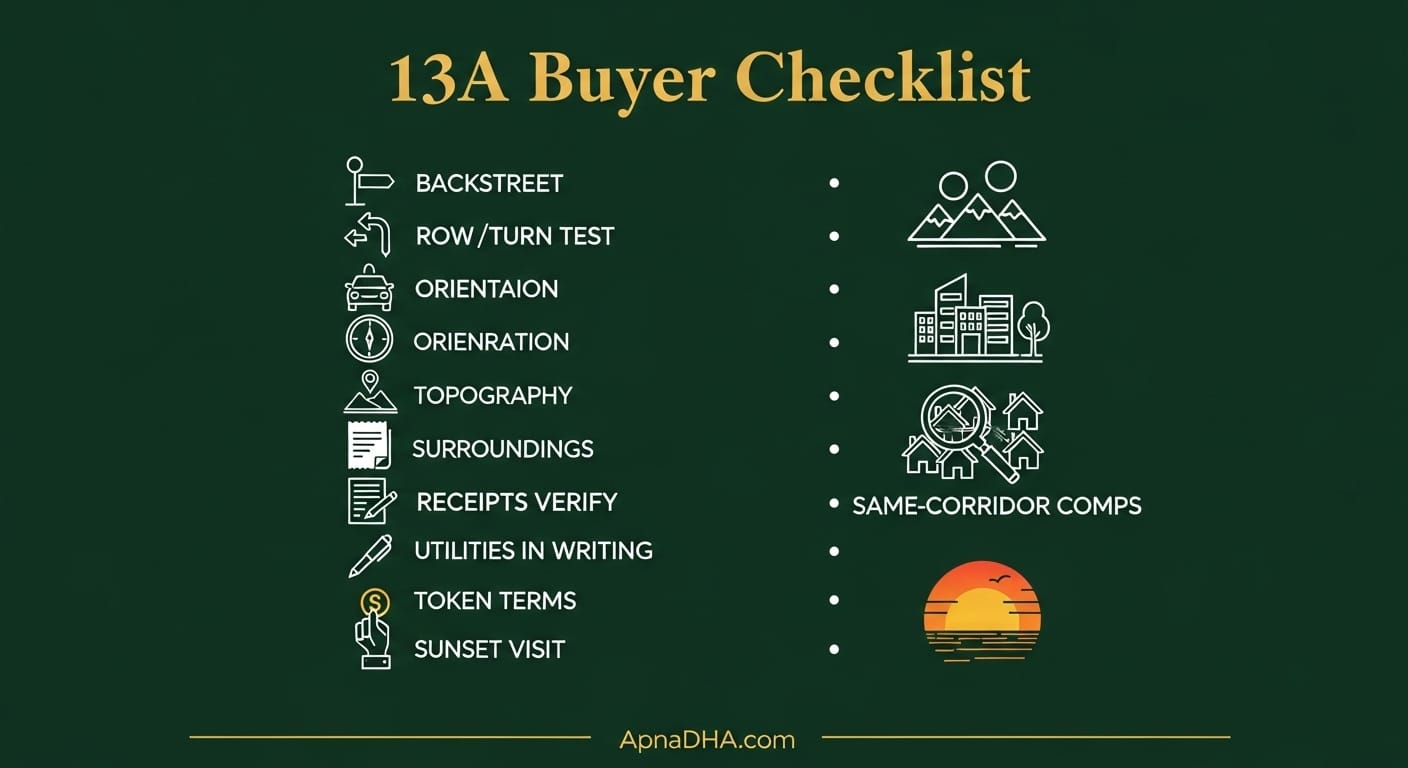

Sector 13A Buyer Checklist (print this)

- Backstreet selection: one–two turns off main; avoid avenue glare/noise.

- ROW & turning: SUV three-point-turn test; gate swing vs sliding; porch depth notes.

- Orientation pricing (same street only): west-open breeze; corner light/parking; park-facing lifestyle (check evening pressure/headlights).

- Topography: lowest-corner water path; list fill/compaction/retaining cost.

- Frontage & massing: façade options, car maneuver, privacy from opposite homes.

- Surroundings finish: paving, signage, lighting, cleanliness, vigilance presence.

- Under-construction load: count active builds; dust/noise horizon matters.

- Paper chain: allotment/transfer history + seller CNIC copies.

- Receipts & dues: verify payments/acknowledgements on official portals before token (screenshots ≠ documents).

- Utilities & possession: insist on written status/timelines (letters/emails).

- Same-corridor comps (60–90 days): collect 3–5 with dates and reference details.

- Token terms: refund triggers, cheque numbers, transfer window, who pays which fees—all in writing.

- Photos & video: porch/approach, lowest corner, manholes, lighting poles, neighbor activity.

- Second visit: walk at sunset to feel wind, traffic, glare, parking behavior.

Ten Common Mistakes in DHA City Karachi Sector 13A (and how to avoid them)

- Cross-sector pricing—every corridor trades differently; price inside your street.

- Avenue-front impulse—prestige now, noise forever.

- Paying park premium blindly—evenings can flip the equation (parking pressure, glare).

- Ignoring slope—water finds the lowest boundary; you’ll pay later if you don’t price it now.

- Tokening on screenshots—verify on the official portal first.

- Under-speccing MEP—thermal/acoustic comfort > façade drama for real daily value.

- Skipping utilities in writing—verbal “soon” is not a milestone.

- No porch/gate geometry check—daily usability (and resale impressions) start at the curb.

- Forgetting service circulation—laundry/utility/refuse lines must not cross formal areas.

- Single visit—sunset reality (breeze, glare, traffic) is different; always do two.

FAQs

Q1. Is Sector 13A good for end-use or investment?

Both. End-users pick 200–300 yds for build-now; investors find value by pricing street-level and quantifying fill/approach/finish.

Q2. Park-facing vs corner vs west-open—what’s best in 13A?

Depends on your street and lifestyle. Price any premium within the same street and only after a sunset check for parking pressure and glare.

Q3. Ready pocket or developing pocket?

Ready pockets cost more but reduce time/utility uncertainty. Developing pockets can be value if they compensate for carry and you have written timelines.

Q4. How do I verify dues/payments before token?

Use the official verification flows so acknowledgements match CNIC/Membership/File info. Screenshots aren’t documents.

Q5. Basement on 13A plots—yes or no?

Case-by-case. Always get a soil investigation and consider water-table/retaining. If not basement, a media/den or sunken lounge can deliver similar vibe with less risk.

Internal Links

- Sectors Hub: /dha-city/sectors

- Neighbor sectors: /dha-city/sector-6 • /dha-city/sector-11e • /dha-city/sector-14a

- Sizes referenced: /dha-city/plots-200-yards • /dha-city/plots-300-yards • /dha-city/plots-500-yards

- Market & paperwork: /dha-city/prices-latest • /dha-city/payment-plans • /dha-city/transfer-fee-process

Conversion Blocks (place near top, middle & end)

ApnaDHA — DHA City Desk

Share budget + preferred streets, and we’ll WhatsApp today’s five best paper-verified 13A options—often with short walk-through videos.

Join The Discussion