(With Lahore & Islamabad Insights)

ApnaDHA Research Desk | October 2025 Market Report

📊 Executive Summary DHA Karachi Investment Strategy 2026

After two volatile years, Pakistan’s property market is showing early signs of equilibrium.

Builder confidence has returned, inflation is cooling, and DHA Karachi once again leads the national recovery cycle.

ApnaDHA Research data (Jan–Sep 2025) indicates:

- Rebuild activity up 18 % YoY

- Construction costs down 7 %

- Average builder ROI 15–18 %

- Rental yields recovering across all DHA chapters

The 2026 cycle will favor agile investors and disciplined builders — those who can rotate capital faster, build smarter, and document their projects under DHA standards.

This report combines verified market data, builder interviews, and national comparisons across DHA Karachi, Lahore, and Islamabad.

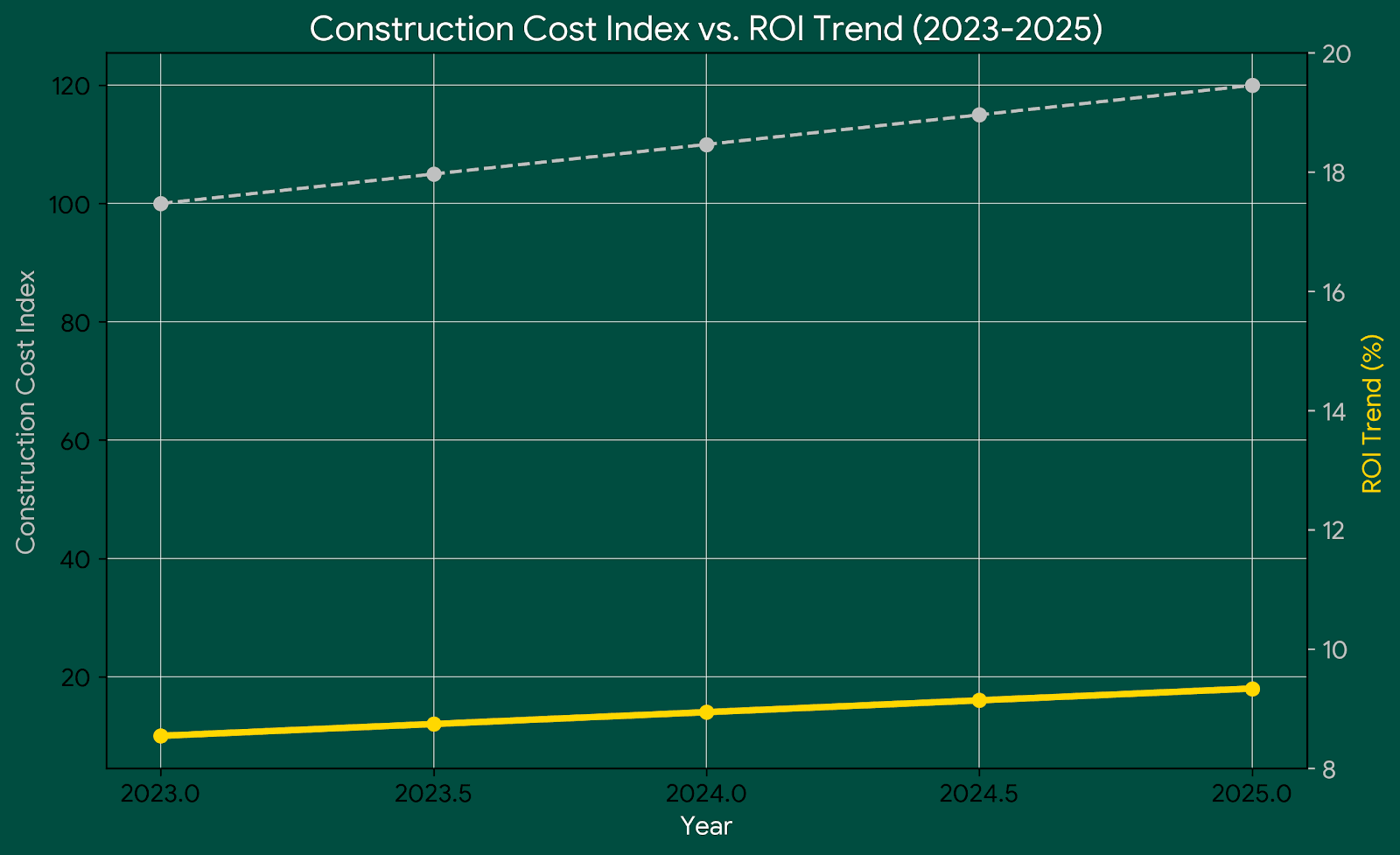

🧱 1. Pakistan’s Real Estate Landscape (2023–2025 Overview)

Between 2023 and 2025, Pakistan’s construction sector experienced turbulence driven by inflation, import restrictions, and political uncertainty.

But since Q2 2025, economic indicators have turned cautiously positive:

| Indicator | 2023 | 2024 | 2025 (Q3) | Trend |

|---|---|---|---|---|

| Inflation (CPI) | 29 % | 21 % | 18 % | 🟢 Decreasing |

| Steel (per ton) | ₨ 275k | ₨ 250k | ₨ 235k | 🟢 −15 % |

| Cement (per bag) | ₨ 1,250 | ₨ 1,150 | ₨ 1,080 | 🟢 −14 % |

| USD/PKR avg | 285 | 296 | 293 | ⚪ Stable |

📊 Source: State Bank of Pakistan Construction Index

Reduced import restrictions have reopened access to branded tiles, wood, and electrical fittings — fueling a finishing boom in DHA Karachi and Lahore.

🏗️ 2. DHA Karachi — Pakistan’s Rebuild Capital

Karachi remains the heartbeat of Pakistan’s property market.

Its resale velocity, rental yield, and construction diversity make it the builder’s city.

Over 40 % of all new projects in 2025 were rebuilds of 15–20-year-old houses.

DHA Phase 6 and Phase 7 Extension dominate this activity, while DHA City is emerging as the next speculative growth zone.

| Phase | Avg Land Rate ₨/yd² (2025) | 2023 Rate | Appreciation | Avg Rental Yield |

|---|---|---|---|---|

| Phase 6 | 1.25 M | 1.05 M | +19 % | 4.8 % |

| Phase 7 Ext. | 0.95 M | 0.78 M | +22 % | 5.1 % |

| Phase 8 Zone D | 1.60 M | 1.35 M | +18 % | 4.5 % |

| DHA City | 0.30 M | 0.24 M | +25 % | 5.5 % |

Analysis:

- Phase 6 remains the benchmark for luxury resale and fastest liquidity.

- Phase 7 Ext. offers builder-level affordability and rapid turnover.

- Phase 8 holds prestige value — ideal for upper-tier investors.

- DHA City Karachi provides future ROI for long-term holders.

📎 Also see: Renovation vs Rebuild Cost in DHA Karachi (2025 Guide)

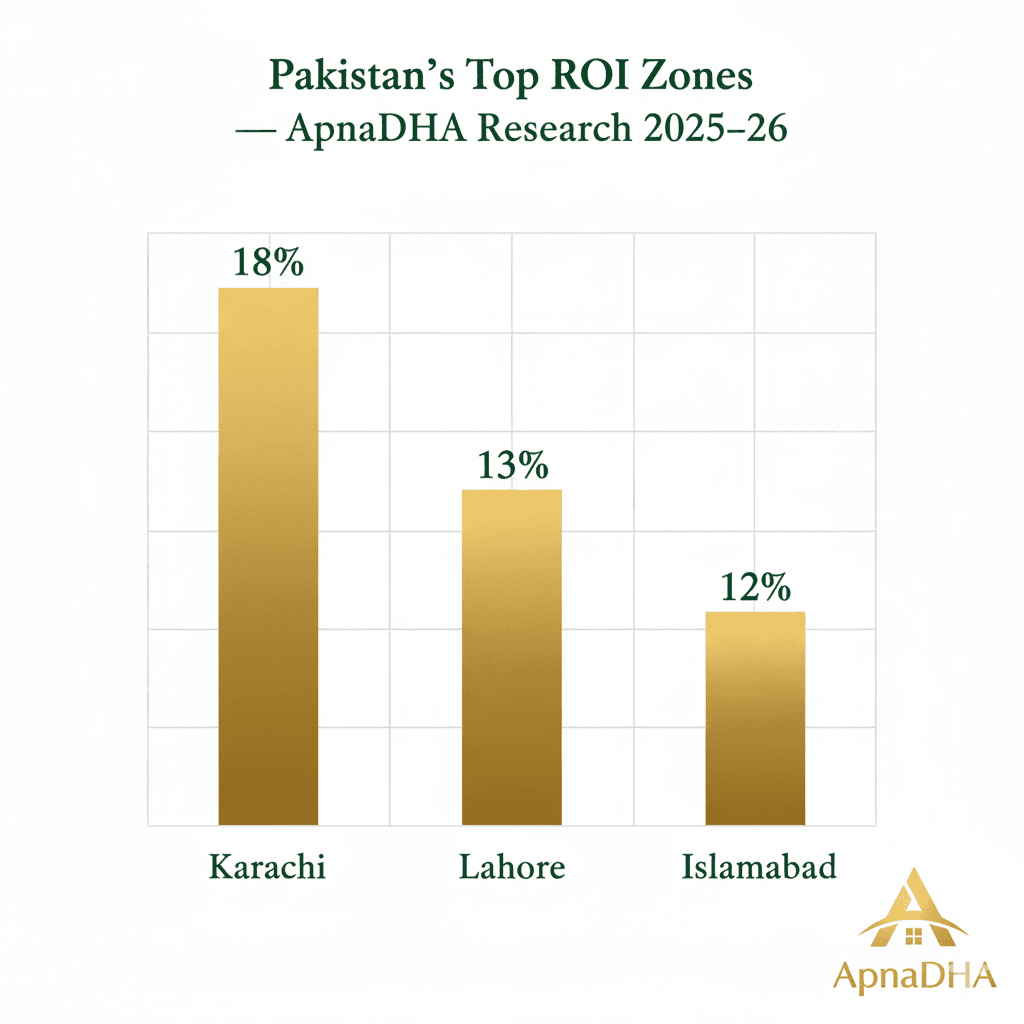

🏙️ 3. Comparing Lahore & Islamabad — Stability vs Expansion

While Karachi drives rebuild ROI, Lahore and Islamabad offer steady, risk-moderate investment environments.

| City | Avg ROI (2025) | Rent Yield | Dominant Trend |

|---|---|---|---|

| Karachi | 15–18 % | 4.8 % | Rebuild boom |

| Lahore | 11–13 % | 4.5 % | Finishing inflation |

| Islamabad | 10–12 % | 5.2 % | G+4 commercial expansion |

Lahore Insight:

Phase 9 Prism and Phase 5 are witnessing premium resale driven by finishing quality, not plot scarcity. Imported tiles, wooden floors, and design-branding (Armani, Porta, etc.) now define price differences.

Islamabad Insight:

DHA Islamabad’s new Phase II Extension has turned into a mini commercial corridor, attracting banks, clinics, and co-working investors. With rent yields above 5 %, it now competes with Karachi in long-term steady returns.

💰 4. Top Builder Investment Models for 2026

| Model | Capital Need | Cycle Time | Expected ROI 2026 | Best Zones |

|---|---|---|---|---|

| 500-yd Luxury Rebuild | ₨ 130 M | 14 mo | 17–19 % | Phase 6, Phase 8 |

| 300-yd Grey Build & Flip | ₨ 65 M | 9 mo | 13–15 % | Phase 7 Ext. |

| G+4 Commercial Build | ₨ 180 M | 18 mo | 14–16 % | Phase 8, DHA City |

Builder Insight (ApnaDHA Survey 2025):

“Smaller projects deliver faster ROI, but branded 500-yd houses secure reputation — that’s the real multiplier.”

📎 Reference: Commercial Building Feasibility (Basement + G+4)

🧱 5. Case Study A — 300-Yard Builder Flip (Phase 7 Extension)

A mid-level builder invested ₨ 60 M in a 300-yd plot, spent ₨ 35 M on construction, and sold for ₨ 95 M in 10 months — yielding 14 % ROI.

Profit drivers:

- 2-unit layout = broader buyer base.

- Quick finish turnaround (9 months).

- Controlled cost with fixed BOQ.

📊 This model remains the fastest capital rotation strategy for 2026.

🏡 6. Case Study B — 500-Yard Luxury Rebuild (Phase 6 Rahat)

| Total Investment | ₨ 130 M |

| Sale Price | ₨ 150 M |

| ROI | 15 % (13 months) |

This rebuild combined smart home automation, solar system, and branded kitchen (Grohe, RAK, Porta).

It sold in under 5 months post-completion — 40 % faster than older stock.

📎 Detailed Case Study: 500-Yard Rebuild ROI Example (Phase 6)

🏢 7. Case Study C — Islamabad G+4 Commercial Block

| Category | Amount (₨ M) |

|---|---|

| Land + Approvals | 95 |

| Construction | 85 |

| Total Investment | 180 |

| Rent Yield | 6 % / year |

| Exit ROI 2026 | 16 % |

Analysis:

Corporate tenancy (banks, brands, co-working) has reduced Islamabad’s commercial vacancy rate to 11 %.

This project type gives predictable long-term cash flow, ideal for large investors.

📉 8. Policy & Tax Environment (2025–26)

Pakistan’s fiscal framework now favors documented builders:

- Capital Gains Tax: 10 % → 5 % after 2 years (FBR 2025 amendment)

- Final Rental Tax: 10 % on declared rentals

- Financing: Meezan & HBL construction loans up to ₨ 30 M

- DHA By-Laws Update: G+2 residential, G+4 commercial + solar requirement

🔗 FBR Valuation Tables

🔗 DHA Karachi By-Laws

📎 Related Reading: Reliable Contractor Checklist (2025)

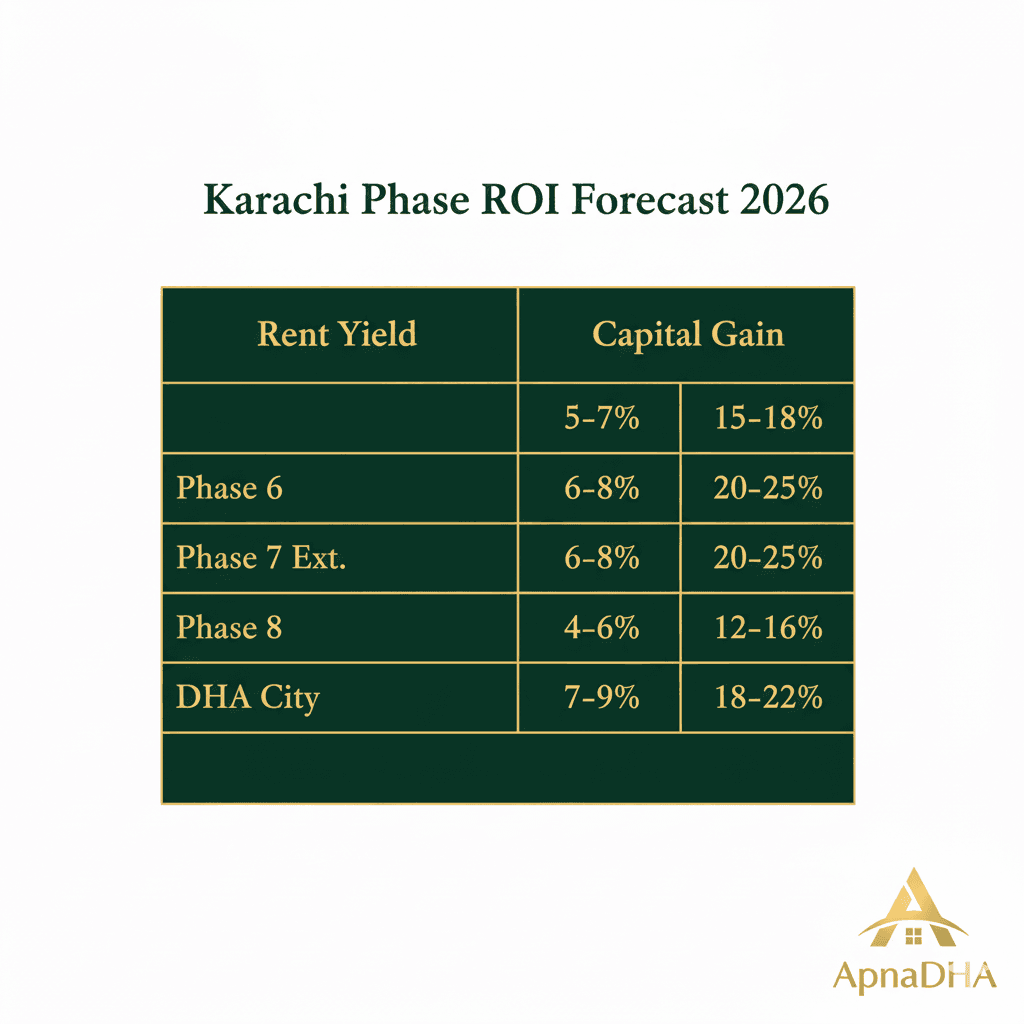

📈 9. 2026 Market Forecast — Rent vs Capital Gains

| Phase | Rent Yield % | Capital Gain % Forecast | Combined ROI % |

|---|---|---|---|

| Phase 6 | 4.8 | 12 | 16.8 |

| Phase 7 Ext. | 5.1 | 10 | 15.1 |

| Phase 8 | 4.5 | 9 | 13.5 |

| DHA City | 5.5 | 15 | 20.5 |

Insight:

Karachi’s luxury phases will remain yield-stable; DHA City and 7 Ext. will outperform in percentage terms due to lower entry costs.

💬 10. Builder Psychology & Market Behavior (ApnaDHA Survey)

- Risk appetite returning: 62 % of builders plan to start new projects in 2026.

- Preference shift: 500-yd rebuilds replacing speculative plot trading.

- Documentation awareness: 78 % now maintain BOQ and photo logs for resale confidence.

📊 Quote from ApnaDHA Agents Lounge:

“Buyers are smarter now — they ask for receipts, taxes, and construction logs. Verified builds sell faster.”

⚙️ 11. Risk Matrix & Mitigation

| Risk | Impact | Mitigation |

|---|---|---|

| Material Inflation | Medium | Pre-book contracts |

| Liquidity Crunch | High | Phased payment with clients |

| Approval Delays | Low | DHA online tracking |

| Labor Shortage | Medium | Keep secondary crew |

| Policy Shift | Low | Monitor FBR portal updates |

💡 12. Strategic Timing — When to Enter 2026 Cycle

- Jan–Mar 2026: Best entry; post-holiday liquidity and stable cement rates.

- Apr–Jun 2026: Builder rotation wave begins; prices rise 5–7 %.

- Jul–Sep 2026: Monsoon slowdown; low activity window for buyers.

- Oct–Dec 2026: Pre-festival demand peak — ideal exit window.

🧭 13. Smart Builder Framework by ApnaDHA

ApnaDHA recommends a 3-step smart builder model:

1️⃣ Data-Driven Decision — Study per sq ft cost & phase ROI via ApnaDHA blog series.

2️⃣ Verified Team Model — Hire documented contractors only (Checklist Link).

3️⃣ Visibility & Network — Post each project free on ApnaDHA.com — Pakistan’s DHA Property Portal to attract genuine buyers.

📈 14. Future of DHA Investment — 2026 and Beyond

The next market cycle will be digital-first and AI-driven.

Agents, builders, and homeowners using verified data (construction cost trends, land rates, solar valuations) will outperform by 20–30 %.

ApnaDHA’s vision is to integrate real-time listings, builder verification, and AI cost estimations to create Pakistan’s first smart property ecosystem.

🏁 Conclusion — Data is the New Property Power

2026 will reward discipline, documentation, and digital visibility.

DHA Karachi remains Pakistan’s most liquid and profitable real-estate region —

while Lahore provides stability and Islamabad offers long-term commercial yield.

Whether you’re a small builder flipping 300 yards or a corporate investor funding G+4 blocks, the key to success is data-backed timing.

📲 Join Pakistan’s First AI-Powered Property Network

Post your projects and listings free on ApnaDHA.com — Pakistan’s DHA Property Portal

and connect directly with verified agents and builders nationwide.

Join The Discussion