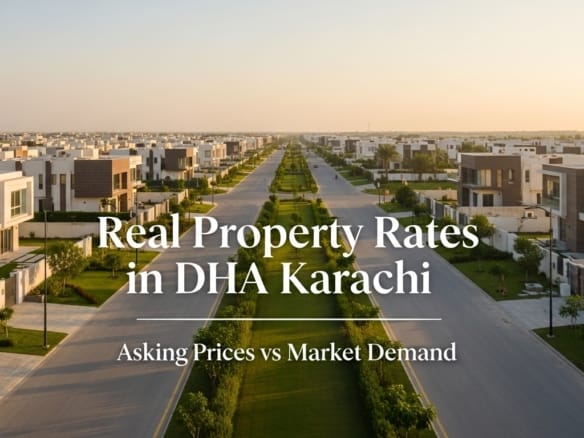

Introduction DHA Karachi house prices 2025 update

DHA Karachi is one of Pakistan’s most coveted residential communities. Its secure environment, planned phases and proximity to the sea make it a top choice for families and investors alike. Keeping up with the latest price movements is essential for anyone buying or selling property in the Defence Housing Authority (DHA). This 2025 update summarises the most recent data on DHA Karachi house prices, analyzes trends across different property sizes and phases, and explores the key factors driving the market this year.

Average House Prices and Historical Growth

The Zameen House Price Index shows that the average price of a house in DHA Karachi reached PKR 17.57 crore in June 2025zameen.com. This is a sharp rise compared with the past decade — prices have increased by PKR 14.27 crore (a 432 % increase) since December 2010zameen.com. Even over shorter periods, the upward trend has continued: six months earlier the average house price was PKR 16.86 crore and has grown by 4 %zameen.com, while a year ago it was PKR 16.67 crore (5 % annual growth)zameen.com.

What this means (DHA Karachi house prices 2025 update)

- Strong long‑term appreciation: Property values in DHA Karachi have multiplied over the past 15 years. This underscores the area’s resilience and appeal to investors.

- Moderate short‑term growth: Recent increases of 4–5 % signal steady momentum rather than a speculative bubble. Investors can expect gradual appreciation rather than dramatic spikes.

Price Trends by Plot Size

Prices vary significantly by plot size. DHA Karachi residents and agents usually refer to plots in square yards, so the table below converts marla/kanal measurements into their yard equivalents. According to Zameen’s index, typical house prices as of July 2025 are:

| Plot Size (approx. in yards) | Traditional measure | Approximate price | Change vs. 2024 |

|---|---|---|---|

| 500 yards | 1 Kanal | PKR 14.69 crore | 6 % increasezameen.com |

| 1 000 yards | 2 Kanal | PKR 24.89 crore | 14 % increasezameen.com |

| 250 yards | 10 Marla | PKR 6.74 crore | 0.8 % increasezameen.com |

| 375 yards | 15 Marla | PKR 9.02 crore | 9 % increasezameen.com |

| 125 yards | 5 Marla | PKR 4.78 crore | 5 % increasezameen.com |

| 175 yards | 7 Marla | PKR 5.73 crore | 9 % increasezameen.com |

| 75 yards | 3 Marla | PKR 3.83 crore | 58 % increasezameen.com |

Note: 1 marla ≈ 25 square yards and 1 kanal = 20 marla ≈ 500 square yards. Prices above represent averages and may vary by phase and property condition.

Insights

- Larger plots appreciate faster: 2‑Kanal houses experienced a double‑digit price increase of 14 %zameen.com, reflecting strong demand for spacious villas.

- Smaller plots are volatile: 3‑Marla houses saw a 58 % spikezameen.com, which may be due to limited supply and increasing interest from entry‑level buyers.

- 10 Marla stability: Prices for 10 Marla houses rose modestly (0.8 %), suggesting this segment is relatively stable and may offer good value for mid‑range buyers.

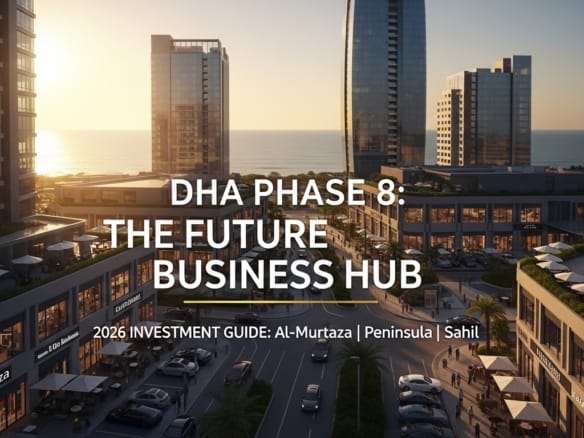

Phase‑Wise Price Comparison of Price Trends by Plot Size (DHA Karachi house prices 2025 update)

DHA Karachi consists of multiple phases, each with unique characteristics and price points. Zameen’s data highlights notable differences:

- Phase 8: The most expensive phase with an average house price of PKR 23.85 crore and a price per square foot of PKR 43,000. Over the past year, Phase 8 prices have climbed by 11 %zameen.com.

- Phase 6: Average price PKR 16.25 crore, with a 1‑year growth of 2 %zameen.com. This phase remains popular due to its established infrastructure and proximity to schools and shopping centers.

- Phase 5: Average price PKR 16.08 crore, with an 11 % annual increasezameen.com. Its central location and mature neighbourhoods attract both families and investors.

- Phase 7 Extension: Despite a lower average price of PKR 6.93 crore, it has maintained steady growth (4 % annually)zameen.com and offers more affordable entry points.

- Phases 1–4 & 7: Prices range between PKR 11.45–17.65 crore with year‑over‑year growth of 2 – 9 %zameen.com. Older phases appeal to buyers who value established communities and larger plot sizes.

Choosing the right phase

Premium buyers gravitate to Phases 5, 6 and 8 for their modern layouts and amenities. Investors seeking capital appreciation may find opportunities in Phase 7 Extension and Phase 2 Extension, where prices are lower but growth potential is higherzameen.com.

Factors Influencing House Prices in 2025

1. New Projects and Investment Options

According to Property Pole, the market is experiencing a “slight correction” as DHA introduces new projects like Indus Hills. These options attract investors away from existing sectors, creating a temporary dip that presents buying opportunitiespropertypole.com. Because of this, prices may stabilise or even soften in some areas before climbing again once new inventories are absorbed.

2. Infrastructure Improvements

The under‑construction Malir Expressway is expected to significantly boost connectivity between DHA and other parts of Karachi. The project includes an upcoming interchange and full completion by November 2026; once finished, it will reduce commute times and make DHA more accessiblepropertypole.com. Improved connectivity typically leads to increased demand and higher property values.

3. Macroeconomic Climate

Overall economic trends—such as inflation, currency fluctuations and government policies—affect construction costs and investment sentiment. Rising inflation and a depreciating Pakistani rupee may drive investors toward real estate as a hedge. Conversely, high interest rates can dampen affordability. Monitoring economic indicators helps buyers time their purchase.

4. Supply and Demand Dynamics

Limited availability of large plots and high demand for secure, gated living keep prices elevated. However, supply in some phases (such as extensions) may increase as new sectors are developed, tempering price growth.

Market Outlook for 2025

Given current data, DHA Karachi appears set for moderate growth through 2025. The Zameen index shows steady year‑over‑year increases of 4–11 % across most phaseszameen.com. With new projects attracting investor interest and infrastructure upgrades on the horizon, prices may temporarily stabilise before resuming their upward trajectory. Savvy buyers can take advantage of any short‑term corrections — particularly in under‑developed phases — while long‑term investors should focus on well‑established phases where demand remains strong.

Practical Advice for Buyers and Sellers

- Buyers: If you’re planning to purchase a home in 2025, consider phases with comparatively lower entry points but strong infrastructure (e.g., Phase 7 Extension). Evaluate property size carefully; smaller plots can appreciate quickly but may be volatile. Keep an eye on macroeconomic conditions and be ready to act when prices soften due to new project launches.

- Investors: Monitor new project announcements like Indus Hills and infrastructure updates such as the Malir Expresswaypropertypole.com. Early entry into emerging sectors often yields higher returns once connectivity improves.

- Sellers: If you don’t need immediate liquidity, holding your property for a bit longer may maximise returns. Property Pole suggests that a strategic waiting period can benefit sellers as the market adjusts and prices recoverpropertypole.com.

Conclusion

DHA Karachi remains a premier real‑estate destination in Pakistan. Average house prices continue to rise, with long‑term appreciation demonstrating the area’s resilience. Yet, 2025 also brings nuanced dynamics: new developments, infrastructural upgrades and macroeconomic shifts will all play roles in shaping the market. Whether you’re buying your dream home or investing for capital gains, staying informed about these trends will help you make confident decisions. Check our neighborhood guides and property listings at ApnaDHA.com to explore current opportunities tailored to your needs.

Join The Discussion