(ApnaDHA Intelligence Report 2025 Edition) (DHA Karachi Investment Strategy 2026)

🏙️ 1. Introduction — The Post-Speculation Era

After half a decade of volatility, 2026 marks Karachi’s first rational real-estate cycle.

The boom-and-bust rhythm of 2018-2022—fueled by cheap credit and rumor—has been replaced by ROI discipline.

From Phase 6’s redeveloped bungalows to Phase 8’s G + 4 plazas and the upcoming DHA City corridor, investors now treat property like a business asset, not a lottery ticket.

This report maps out the next strategic moves for builders and investors across DHA Karachi.

📈 2. From 2023 Correction to 2026 Clarity

| Year | Market Theme | Investor Mood | Outcome |

|---|---|---|---|

| 2023 | Inflation shock, high interest rates | Fear | Liquidity crunch |

| 2024 | Tax tightening & grey-market cleanup | Adjustment | Plot trading down |

| 2025 | Yield awareness & ROI focus | Confidence returns | Apartments rise |

| 2026 → | Calculated building & portfolio diversification | Professional | Sustainable growth |

🧭 Meaning: Those who built instead of holding land in 2024–25 are the ones now earning double-digit returns.

🏗️ 3. Phase-Wise Investment Blueprint (2026 Strategy Map)

| Phase | Investor Profile | Land Rate ₨/yd² | 2025 ROI | 2026 Forecast | Best Play |

|---|---|---|---|---|---|

| Phase 8 (Zones A–E) | Builders & brands | 1.3–1.6 M | 11–13 % | 13–14 % | G + 4 plazas with basement parking |

| Phase 6 (Shahbaz / Rahat) | End users / clinics | 950 k–1.1 M | 8–9 % | 9–10 % | Dual-unit houses or commercialized bungalows |

| Phase 7 Ext. | Small builders | 650 k–750 k | 10 % | 11–12 % | Buy old home → rebuild → sell within 12 m |

| Phase 4 | Families | 850 k–950 k | 9 % | 10 % | Low-risk rental units |

| DHA City Karachi | Long holders | 150 k–180 k | — | +10–12 % | Hold & build 2027 onwards |

📊 Insight: Phase 8 is the ROI engine; Phase 6 is the rental hub; DHA City is the future bet.

💰 4. ROI Benchmarks (2025 → 2026 Shift)

| Asset Type | 2025 ROI | 2026 Projection | Change | Driver |

|---|---|---|---|---|

| Luxury Bungalows | 3–4 % | 4–5 % | ↑ | End-user upgrade |

| Apartments | 9–10 % | 10–11 % | ↑ | Corporate tenants |

| Commercial Plazas | 12–13 % | 13–14 % | ↑ | Brand expansion |

| Small Buildings | 13–14 % | 13 % | ≈ | High base |

| DHA City Plots | 0 % | 10–12 % (2028) | ↑ | Infrastructure growth |

🧱 5. What Builders Are Doing in 2026

A. Phased Portfolio Model

Top builders split their capital into three tracks:

- One active commercial build (G + 4).

- One renovation flip project.

- One land bank plot for next cycle.

B. Project Cycle Discipline

Average construction cycle has shrunk from 18 → 13 months.

“Speed is ROI,” says Phase 8 developer — a 3-month delay can erase 2 % return.

C. Material Optimization

Builders now pre-book tiles, lights, and wood work with vendors through ApnaDHA Marketplace to lock rates.

🏠 6. Residential Strategy — Rebuild & Resale

Older houses (15–20 yrs) in Phase 6 and 7 Ext. offer best short-term profits.

Example:

- Purchase: ₨ 105 M

- Renovation: ₨ 22 M

- Sale: ₨ 150 M

➡ Net Profit: ₨ 23 M (22 %) within 11 months.

🧱 Key Tip: use branded finishes (GM, Master, Schneider) — buyers pay premium for documented material lists.

🏢 7. Commercial Plaza Forecast — The 2026 ROI Champion

Phase 8 and Ittehad Boulevard remain prime.

| Location | Land Cost (₨) | Build Cost (₨/sq ft) | Total Outlay (₨ M) | Rent (₨ M / mo) | ROI |

|---|---|---|---|---|---|

| Zone D Phase 8 | 180 | 6,800 | 235 | 2.9 | 12.6 % |

| Ittehad (7 Ext.) | 160 | 6,500 | 220 | 2.6 | 12 % |

| Phase 6 Commercial | 140 | 6,300 | 205 | 2.2 | 11 % |

🧩 2026 Trend: Joint ventures between land owners and builders increase capital turnover by 30 %.

🏙️ 8. Apartment Economy — Rise of Corporate Rentals

Corporate leasing now dominates Clifton Blocks 7-8 and Phase 8.

| Project | Price ₨ M | Rent ₨ k | Yield | Tenant Type |

|---|---|---|---|---|

| Creek Vista | 42 | 350 | 10 % | Multinational |

| Reef Tower | 38 | 300 | 9.5 % | Embassy staff |

| Nishat Comm. | 25 | 220 | 10.5 % | Local executives |

💡 2026 Pro Tip: Add furnishing + smart lighting → rent premium +15 %.

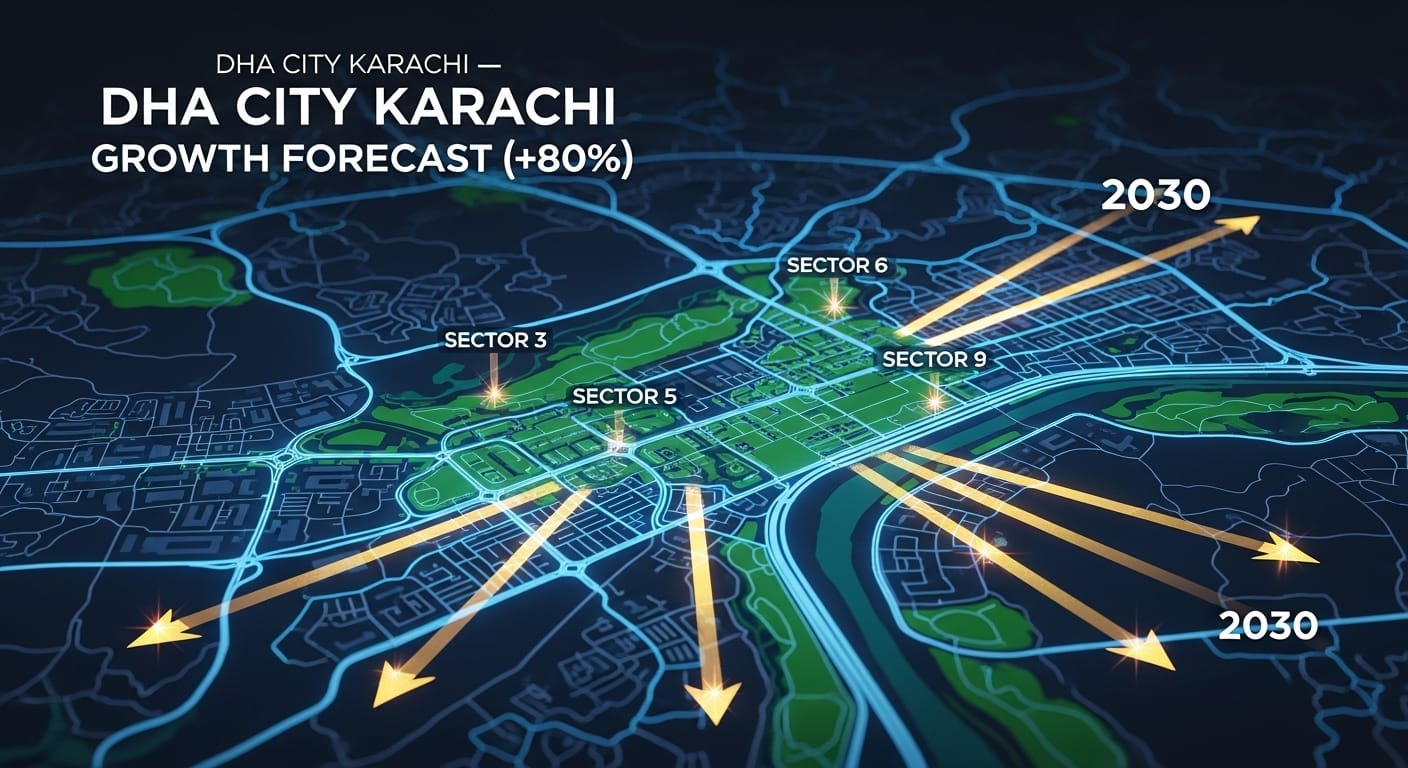

🌆 9. DHA City Karachi — The 2026–2030 Play

Infrastructure completion is triggering phase-two value unlock.

- Roads & utilities : 90 % core zones ready

- Livability ratio : 40 % by mid-2026

- Avg 500 yd price : ₨ 7.5 → ₨ 9 M (2026-28)

- Apartments : pre-approval for G + 3 blocks begun

📈 Projection: 60–80 % capital gain by 2030.

📎 See DHA City Development Update →

🌍 10. Overseas Investor Framework (2026 Policy)

| Option | Capital ₨ | Annual Yield | Holding | Why it Works |

|---|---|---|---|---|

| Furnished Apartment | 30–40 M | 9–10 % | 2–3 yrs | Easy to manage remotely |

| Commercial JV | 200–250 M | 12–13 % | 5 yrs | Brand tenant security |

| Rebuild Project | 120 M | 20–25 % resale | 1 yr | Quick turn |

| DHA City Plot | 7–8 M | 0 → 10 % | 5 yrs | Appreciation |

💡 ApnaDHA tip: use DHA-registered property managers for tax filing & tenant control.

⚙️ 11. Tax & Policy Landscape 2026

| Measure | 2026 Rule | Investor Impact |

|---|---|---|

| Capital Gains Tax | 3-year slab 10→5→0 % | Encourages medium-term holding |

| Rental Income Tax | Final 10 % | Predictable |

| Commercial NOC | Mandatory for > G + 2 | Quality control |

| FBR Valuation | Revised mid-2025 | Documentation essential |

🧩 Implication: 2026 favors documented, DHA-approved projects over informal builds.

📊 12. Risk Dashboard & Mitigation

| Risk | Severity | Mitigation |

|---|---|---|

| Material inflation | High | Pre-book contracts |

| Interest rates | Medium | 30 % leverage cap |

| Rental oversupply | Low | Focus Phase 6 / 8 |

| Policy changes | Medium | Stay compliant via DHA portal |

🔮 13. 2026–2030 Forecast Timeline

2026–27: Commercial ROI peak (13–14 %).

2027–28: Apartment boom + DHA City habitation.

2028–29: Tax incentive reforms → new builder cycle.

2029–30: Karachi dual-market model finalized — DHA Core = Income, DHA City = Growth.

By 2030, ₨ 230 M plaza (2025 build) could value ₨ 320 M with steady rent flow.

🧾 14. Strategic Checklist for 2026 Investors

- Avoid idle plots — build or partner.

- Plan finishing before foundation. (locks 20 % savings)

- Use ApnaDHA Feasibility Sheets for BOQ control.

- Blend portfolio: 1 apartment + 1 small commercial.

- Stay documented: digital transfers = trust.

🧠 15. Key Takeaways at a Glance

| Theme | 2026 Reality | Strategic Action |

|---|---|---|

| Market Nature | ROI driven | Think like a builder |

| Top Performer | Commercial plazas | Joint venture model |

| Safe Play | Furnished apartments | Corporate tenants |

| Future Bet | DHA City plots | 5-year hold |

| Biggest Mistake | Idle capital | Turn every asset productive |

🏁 16. Conclusion — The Age of Data-Driven Building for DHA Karachi Investment Strategy 2026

2026 is the turning point for Karachi real estate.

Plots alone don’t create wealth anymore; projects do.

The new builder is a strategist — balancing ROI, speed, and design.

- Apartments = steady cash flow (10 %)

- Commercial plazas = double-digit ROI (13–14 %)

- DHA City = long-term growth (10–12 %)

ApnaDHA continues to lead with verified data, market analytics & networked agent intelligence.

📲 WhatsApp: 0331-8208177

🌐 Visit: ApnaDHA.com

💬 Join Agents Lounge — Pakistan’s first social network for DHA professionals.

ApnaDHA — Pakistan’s DHA Real Estate Intelligence Platform

Join The Discussion