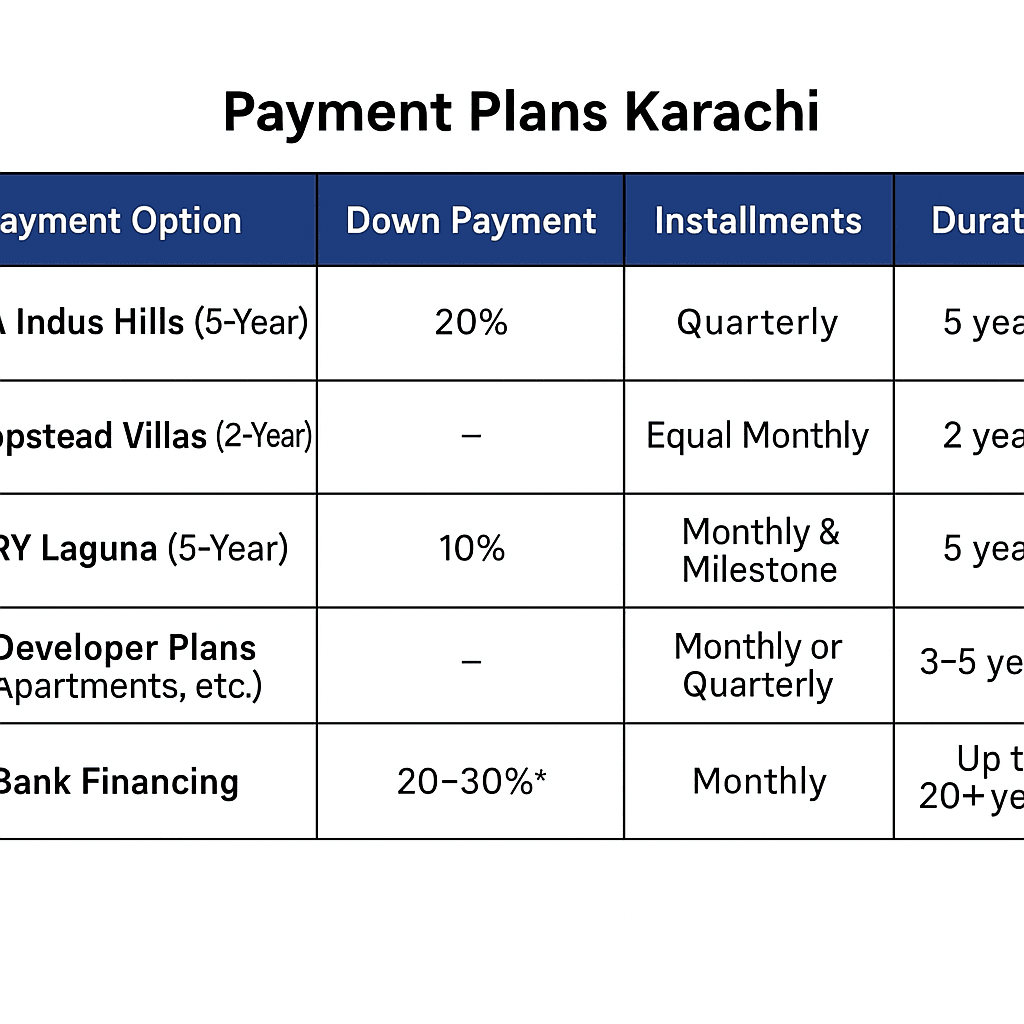

Investing in Defence Housing Authority (DHA) Karachi can be a lucrative venture, especially with the flexible DHA Karachi Payment Plans 2025 Whether you’re eyeing a new plot in DHA City Karachi’s Indus Hills or a luxury apartment by a private developer, it’s crucial to understand the financing options available. This comprehensive guide breaks down official DHA Karachi installment plans (for both residential and commercial properties), third-party developer-led payment offerings, and bank financing solutions. We’ll also provide 2025 payment schedules and strategic financial planning tips to help you navigate the current real estate and economic landscape.

Official DHA Karachi Payment Plans 2025 (Residential & Commercial)

Artist’s rendition of the entrance to DHA City Karachi’s Indus Hills project, which offers residential and commercial plots on flexible payment plans.

DHA Karachi (DHA City) – Indus Hills

📊 5-Year Installment Plan Summary (2025)

| Plot Type | Plot Size | Total Price (PKR) | Down Payment (20%) | Quarterly Installment | Installment Duration | Lump Sum Price (10% Discount) |

|---|---|---|---|---|---|---|

| Residential | 125 Sq. Yds | 3,200,000 | 640,000 | 128,000 | 5 Years (20 Quarters) | 2,880,000 |

| Residential | 500 Sq. Yds | ~9,375,000 | ~1,875,000 | ~375,000 | 5 Years (20 Quarters) | ~8,437,500 |

| Commercial / Mixed-Use | 133 Sq. Yds | 16,000,000 | 3,200,000 | 640,000 | 5 Years (20 Quarters) | As per DHA offer |

📝 Notes

- All plots are offered on 5-year quarterly installment plans

- Total 20 quarterly installments

- 20% down payment mandatory at booking

- Lump sum payment within 30 days qualifies for approx. 10% discount

- Project includes Residential, Overseas Enclave & Commercial plots

🔔 Prices and payment plans are subject to DHA Karachi notifications and availability.

👉 View Latest Indus Hills Availability & Chance Deals

2-Year Installment Schemes – Hampstead Villas: In addition to Indus Hills, DHA City Karachi introduced an accelerated payment plan for ready-built properties. Hampstead Villas – a joint venture project in DHA City’s Sector 1 – offers luxurious pre-constructed villas on a 24-month installment schedule. This 2-year plan is a rarity for DHA, aimed at making homeownership more accessible. Buyers pay a certain booking amount and then equal installments over 24 months to own a completed villa (with full DHA allotment rights). The shorter payment horizon appeals to those who prefer quicker ownership transfer. According to project details, the installment option marks the first time in years that DHA City is offering ready homes on a 2-year plan, significantly lowering the barrier to entry for buyers who can commit to a larger installment in a shorter timeframe.

Other DHA Karachi Projects: While DHA Karachi’s established phases (e.g. Phase VI, VII, VIII in the city) typically involve upfront purchases or secondary-market sales (since those phases are long developed), DHA City Karachi (located on M-9 Motorway) is where new official installment schemes are actively in place. Initially launched in 2010, DHA City’s earlier plot allotments followed a 10-year installment schedule for civilians (and 20-year for army personnel). By 2025, most original DHA City plots have been allocated, and focus has shifted to new pockets like Indus Hills (5-year plan) and limited “fast-track” plots in DHA City (South) on shorter 2–3 year plans. For instance, some plots in developed sectors of DHA City (South) were announced on a 2-year installment plan – allowing investors to capitalize on near-possession plots with a shorter payment duration. These official DHA schemes often require a processing fee at application, a substantial down payment upon ballot confirmation, and then regular installment payments (quarterly or semiannual). Always refer to DHA’s official publications for the latest rates and schedules, as they are updated with each new launch or ballot.

Third-Party Developer Installment Offerings in DHA Karachi

Beyond DHA’s own offerings, numerous private developers and joint ventures within DHA Karachi are providing attractive installment-based payment plans in 2025. These range from high-rise apartments in DHA Phase 8 to mixed-use mega projects in DHA City. Such plans are typically tailored by developers to broaden their buyer base, often featuring longer durations or creative installment structures.

A concept rendering of the high-rise towers in ARY Laguna DHA City – a private development featuring Pakistan’s first man-made beach lagoon with apartments available on multi-year installment schedules.

ARY Laguna (DHA City Karachi): A landmark joint venture between ARY Group and DHA, ARY Laguna is Pakistan’s first-ever man-made beach community within DHA City. The apartments in ARY Laguna were offered on a flexible 5-year payment plan designed to be as affordable as possible for mid-income buyers. The payment schedule is nuanced: after a small booking fee, only 5% is due 2 months after booking, followed by a 10% down payment after successful balloting at realprojects.com. Subsequent payments are broken down into stages – e.g. 6% payable at 5, 8, and 11 months from booking – and monthly installments of 1% of unit price for a set number of months (typically totaling 3 to 5 years of monthly payments). A final 20% is due upon project completion and handover to realprojects.com. This innovative mix of milestone-based payments plus monthly installments has made ARY Laguna fairly accessible; for a modest-sized apartment, buyers spread payments over several years instead of paying lump sum. The DHA management oversees transfers and lease formalities, giving investors added confidence. As of 2025, many buyers are midway through their installment schedules for ARY Laguna’s first development phase, with handovers expected in coming years as towers are completed.

High-Rise Apartments in DHA Phase 8 (HMR Waterfront, Emaar, etc.): DHA Phase 8, Karachi’s upscale seaside phase, has seen a surge of private projects offering installment plans. For example, the HMR Waterfront community (an oceanfront development in Phase 8) hosts projects like Saima Tower and Metro Seafront Residences with multi-year payment plans. Saima Tower Apartments (a 40-story residential tower by a renowned builder) provides a 5.5-year installment plan: buyers pay roughly 10–15% in booking/allocation fees and then 22 quarterly installments (spread over ~5.5 years) along with stage payments during construction. For instance, a 1-bedroom sea-facing unit (~PKR 39.9 million price) in Saima Tower required a booking of PKR 1.5 million, similar payments at allocation and confirmation, and then 22 quarterly installments of PKR 0.9 million (plus smaller slab-wise payments during construction). Larger units (2, 3, 4 bedrooms, penthouses) follow the same structure with proportional installment amounts, culminating with finishing and possession payments around 2029.

Another example is Metro Seafront Residences in Phase 8, which offers 1–3 bedroom luxury apartments with a unique hybrid monthly installment plan. A 3-bedroom sea-facing apartment (price ~PKR 106 million) could be booked with PKR 2.5 million down, followed by 9 monthly installments of PKR 2.5 million each, then reduced monthly payments (PKR 1.2 million) until possession, with the remaining balance due on possession This front-loaded plan helps the developer fund construction early on, while still giving buyers a few years of payment breathing room (possession is expected by 2029)Many such developer-led plans in Phase 8 span 3–5 years and often synchronize with the project’s construction timeline (ensuring the property is completed by the time installments end).

DHA City Private Developments (Burj Quaid, etc.): In DHA City Karachi, apart from DHA’s own Indus Hills, private builders are introducing projects with installment options. Burj Quaid is one notable development – poised to be Pakistan’s tallest residential tower in DHA City – offering apartments and offices on a 50-month installment plan

. For example, a 1-bed apartment (total price PKR 12 million) requires a down payment of PKR 1.5 million and the rest is paid via 50 monthly installments of PKR 80,000 plus 10 semi-annual payments of PKR 530,000, with a final balloon payment at This effectively spreads the cost over just over 4 years. Larger units (2-bed, 3-bed) have higher installment amounts but the same 50-month (~4.2 years) schedule. The developer (ABS Developers) has even structured it such that there are both monthly and bi-annual payments, making it somewhat easier to manage than purely monthly hefty sums.

Key Takeaway: Third-party installment offerings in DHA Karachi often extend 3 to 5+ years, with some creative payment schemes (monthly, quarterly, bi-annual, or milestone-based). They usually require a lower initial outlay (often 5–30% of price) and then stagger the rest to coincide with construction progress. It’s vital to assess the credibility of developers and ensure the project has DHA’s NOC (No Objection Certificate). Projects like ARY Laguna and Burj Quaid come with DHA’s endorsement or oversight, adding security for investors. Always review the schedule of payments in detail – note the frequency (monthly vs quarterly), any balloon payments at the end, and whether the installment amounts are fixed or increase over time (some plans might have escalating installments). Comparing a few options side-by-side can help in choosing a plan that fits your cash flow.

Bank Financing Options for DHA Karachi Properties

Not all investors will opt for developer or DHA installment plans – some may purchase ready properties or require additional funds to meet payment schedules. This is where bank financing (mortgages) comes in. Pakistani banks and Islamic financing institutions offer home financing for DHA Karachi purchases, with varying terms, eligibility criteria, and interest (or profit) rates. In 2025, as economic conditions improve and interest rates stabilize, mortgage options are becoming more attractive for property buyers.

Home Loans & Islamic Financing: Major banks such as HBL, UBL, Standard Chartered, and dedicated Islamic banks like Meezan and Dubai Islamic all provide home loan products. Typically, banks finance up to 70–75% of the property’s value, requiring the buyer to contribute the remainder as down payment (25–30%). Loan tenures are flexible, ranging from 5 years up to 20–25 years in some cases. This allows borrowers to choose shorter loans (higher monthly payments but less total interest) or longer loans (lower monthly payments but more interest over time). Eligibility generally depends on stable income and creditworthiness: salaried individuals must show employment and income proof, while self-employed/business persons need to document their business income. Banks often cap the loan such that monthly installments do not exceed a certain portion of the borrower’s income (to ensure repayment capacity). Age limits apply too – e.g. the loan should typically end by the time the borrower is ~60–65 years old (retirement age).

Interest Rates (2025): After a period of high interest rates in 2023–24, Pakistan’s central bank adopted a more accommodative stance in 2025, easing borrowing costs for consumers. As a result, mortgage interest rates (or Islamic financing profit rates) in 2025 are hovering in the low-to-mid teens. For instance, Meezan Bank’s Islamic home finance offers a fixed rate of ~12.5–13% for the first 3 years, followed by a floating rate pegged to the prevailing KIBOR + margin. Conventional banks similarly might offer introductory fixed rates around 13–14%, with subsequent adjustments. Some banks quote rates like “KIBOR + 3%” for salaried borrowers (with a floor and cap) meaning if the 1-year KIBOR is, say, 10%, the effective rate would be 13%. As of mid-2025, the policy rates have started to come down, so new home loan customers could see slightly lower rates than the peak of the prior years. It’s wise to compare offers: look at any fixed-period rates, processing fees, and early payment penalties. Also consider Islamic vs conventional loans – Islamic banks use Diminishing Musharakah (co-ownership leasing) structures which are Shariah-compliant but effectively result in similar periodic payments to a conventional loan. The choice may depend on personal preference for Shariah compliance and the specific rate offer.

Loan Process & Using Financing in DHA: Obtaining a home loan for a DHA property usually involves the bank evaluating the property’s documents (to ensure clear title and that it’s in DHA’s approved list) and the borrower’s financials. DHA Karachi’s properties are generally highly regarded by banks (due to reliable title deeds/lease and strong value), so financing for DHA homes or plots is readily available. Some banks have even run special campaigns for DHA properties. The process entails: application and document submission, legal check and valuation of the property, loan approval, and then issuance of a loan sanction letter. The bank will disburse the loan amount directly to the seller (or developer) as needed, and in return, a mortgage is marked on the property. Keep in mind, if you are buying a plot on installment (from DHA or a developer) and need financing to help with payments, banks might offer construction loans (if you plan to build) or require the property to be completed before financing. As an investor, you could also refinance a property after taking possession (to pull out equity).

Example: Suppose you plan to buy a house in DHA Karachi for PKR 50 million. You could pay 30% (~15 million) from your own funds and finance the remaining 35 million via a bank over 15 years. At a 13% annual interest rate, the monthly installment would be roughly PKR 450,000 – 500,000. As rates fluctuate, many banks allow choosing fixed-rate periods (e.g. fixed for 3 or 5 years, then variable) to balance predictability and potential rate drops. Some also offer step-up installments or flexible payment plans where you pay smaller amounts in initial years and larger later (useful if you expect your income to rise), meezanbank.com.

Finally, note that there have been government-backed low-interest schemes (like the Mera Pakistan Mera Ghar program at subsidized rates)sbp.org.pk. However, such schemes have been on hold amid economic adjustments. It’s possible new incentive programs may emerge, so keep an eye on State Bank or government announcements if you’re seeking subsidized financing for housing.

2025 Payment Schedules & Market Outlook

Understanding the timelines of various payment plans is key to planning your investment. Here’s a quick overview of 2025-era payment schedules for different options in DHA Karachi:

- DHA Indus Hills: Balloting took place in mid-2025, and installment schedules started soon after. The quarterly installments will run from 2025 through 2029 (five years total). For example, for an allottee who paid the 20% down payment by August 2025, the first quarterly installment would be due perhaps in Q4 2025. Thereafter, 20 equal installments are due every 3 months. The final installment will likely fall in late 2029, after which possession of plots is expected (development work is commencing in 2025 with promises of fast-tracked progress). DHA has been punctual with its installment timelines, but they also provide some flexibility (e.g. grace periods or extensions in special cases). Indeed, DHA City Karachi extended the down payment deadline for Indus Hills until August 24, 2025 to facilitate investors, showing some accommodative measures.

- 2-Year Plans (Hampstead Villas): Launched around mid-2025, these have a 24-month cycle. If a buyer started in June 2025, their installments will run through mid-2027. Typically, installments might be monthly or quarterly – the exact schedule (monthly vs quarterly) is set by the developer/DHA joint venture. Given the short span, expect higher installment amounts (e.g. paying 50% of the villa price in the first year, 50% in the second year, or similar) in exchange for getting the keys quickly. The villas are under construction with an aim to hand over by the end of the 2-year plan, aligning possession by 2027 when all payments are completed.

- Developer Projects Phase 8 (4–5 year plans): Projects like Saima Tower, Metro Seafront, etc., launched sales in 2023–2024, so their installments run roughly 2024–2028/29. Many have quarterly installments extending into 2028, with possession around 2028–29 (Saima Tower’s 22 quarterly installments + finishing payments lead to possession by ~2029; Metro Seafront’s plan also targets 2029 handovert. If you’re joining in 2025 or later, you might be entering an ongoing payment schedule (sometimes developers allow new buyers to take over existing payment plans of earlier allottees). Be sure to check how many installments have already been paid and what remains.

- ARY Laguna: Sales launched in late 2020 and balloting in 2021, so its payment schedule spanned about 2021–2025 for initial allottees (with possible extensions). Many ARY Laguna buyers are entering the final stretch of payments by 2025. The plan was around 4–5 years total, so those who got units in early towers might see completion and demand notices for the final 20% (on completion) by 2025 or 2026. However, keep in mind that large projects can face delays; any extension in construction timeline could push the completion payment further out. As of early 2025, construction in ARY Laguna was in full swing (with site works and infrastructure development actively progressing)

- Market Forecast: The real estate and economic landscape in 2025 is cautiously optimistic. After a turbulent couple of years with high inflation, things are stabilizing. Interest rates have plateaued or begun to decrease slightly, which is reviving interest in mortgages and financed purchases. For investors, this means financing costs might gradually decline, making it easier to service a loan or installment plan over the coming years. On the flip side, property prices in DHA Karachi have historically trended upward, and new infrastructure (like the nearly completed Malir Expressway, which will drastically cut travel time to DHA City) is expected to boost property values in outlying projects. For example, analysts projected that ready villas in DHA City could see appreciation up to 200% within two years of possession, partly thanks to improved connectivity. While 200% may be an aggressive figure, it underscores the bullish sentiment for well-planned developments.

2025’s market also rewards strategic timing: buying into installment projects at launch (locking in today’s price) can yield significant gains by completion, as Pakistan’s inflationary environment often pushes property prices higher over 5 years. That said, prudent investors should monitor macroeconomic indicators – if inflation resurges or political stability wavers, the real estate sector could slow down temporarily. Always keep an eye on DHA’s official announcements, credible real estate forums, and market reports for the latest updates on payment deadlines, ballot results, or policy changes that might affect your investment.

Strategic Financial Planning Tips for DHA Investors for DHA Karachi Payment Plans 2025

Entering a long-term financial commitment for a property requires careful planning. Here are some tips to ensure your investment in DHA Karachi is both financially sound and strategically positioned for growth: “DHA Karachi Payment Plans 2025”

- Assess Affordability and Plan Cash Flows: Before committing to any payment plan, do a realistic budget analysis. The goal is to ensure you can comfortably pay all installments or mortgage payments on time. Remember that installment plans (whether DHA or developer) often carry surcharges for late payment – DHA, for instance, charges late fees (surcharge) on delayed installmentsdhakarachi.orgdhakarachi.org. Missing payments could also lead to cancellation in worst cases. As a rule of thumb, your monthly or quarterly property payments should come from disposable income after covering living expenses. Build a buffer for unexpected events; having 3–6 months of installments saved as an emergency fund is wise.

- Compare Financing vs Installment Plans: If you have the option, compare the total cost of different financing routes. DHA/developer installments are usually interest-free but the property price might be higher than a cash price (e.g. Indus Hills plots cost ~10% more on the 5-year plan than lump sumindushills.dhacitykarachi.org.pk). Bank financing allows you to pay a lower price upfront (possibly negotiating a better deal from a seller for cash) but you’ll pay interest to the bank. Calculate the total you’ll pay over the loan term. In some cases with high interest rates, a 20-year mortgage can mean paying 2x the property price in interest. However, with rates easing and inflation high, taking a loan can be advantageous if property values rise sharply (you pay the bank in future rupees which may be worth less due to inflation, while your property’s value climbs). It’s a delicate balance – some investors use a hybrid approach: e.g. make maximum down payment or prepayments to minimize interest, while still leveraging some financing for flexibility.

- Optimize Use of the Focus Keyword: (SEO Tip – If you’re writing about these plans as a blogger or marketer, naturally incorporate phrases like “DHA Karachi payment plans 2025” in your headings and content.) For instance, title your content clearly (as we did here) and mention the year and key topic early on. This ensures that anyone searching for up-to-date 2025 DHA Karachi installment plans or financing options can easily find relevant information. Combining clear headings, bullet points for important details, and tables (for schedules or comparisons) not only aids SEO but also improves reader comprehension.

- Stay Informed on Economic Trends: Keep track of where interest rates and inflation are heading. In an environment where interest rates drop, consider refinancing any high-interest loan you took earlier. Many banks offer balance transfer facilities (like Meezan’s Easy Replacement to transfer a loan from another bank)meezanbank.com which you can use to get a better rate if the market improves. Conversely, if high inflation persists, locking in a fixed-rate mortgage (so your rate doesn’t climb) might save money. Inflation also affects construction costs; if you’re on an installment plan for a building under construction, be financially prepared in case developers demand some cost escalation (it’s not common in DHA projects to increase price for existing allottees, but smaller builders sometimes pass on extreme cost increases).

- Due Diligence on Developers and Projects: When dealing with third-party installment offerings, research the developer’s track record. Are their previous projects delivered on time? Do they have a good reputation? For projects like ARY Laguna or Emaar’s ventures, there’s strong backing and transparency. But for lesser-known builders, verify that the project is SBCA approved (Sindh Building Control Authority) and has DHA’s no objection certificates. Avoid deals that sound too good to be true (extremely low booking amounts or very long installments with no interest – sometimes a sign of a risky project funding scheme). It’s often safer to invest in projects where DHA is directly involved or monitoring – for example, the Hampstead Villas are a JV with DHA, providing extra security to buyers.

- Plan for Ancillary Costs: Buying in DHA entails some additional expenses. Transfer fees, membership fees, utility connection charges, taxes (stamp duty, CVT, etc.) will come into play either at the time of transfer or possession. Factor these into your budget. If you’re using bank financing, note that banks will require property insurance and sometimes life/disability insurance for the borrower – adding to annual costs. DHA City Karachi also has maintenance charges once you take possession. It’s best to make a checklist of these potential expenses so they don’t surprise you at the end of your payment plan.

- Exit Strategy and Investment Horizon: If you’re an investor (rather than intending end-user), have a strategy in mind. Some investors flip the plot/house during the installment period (after a few installments when the asset has appreciated and demand is high). Others plan to hold long term for rental income (especially for apartments or commercial units). DHA Karachi’s market is generally liquid for prime areas, but in new projects like DHA City, consider a realistic time frame for liquidity. It might take until possession (or near possession) to realize full market value. Therefore, ensure you can sustain the payments until at least that point. The projected completion of the Malir Expressway by ~2026-27propertypole.com is a key factor – many anticipate a surge in DHA City values around then. Align your investment horizon with such milestones to maximize returns.

In conclusion, financing your DHA Karachi investment in 2025 is about balancing opportunity with affordability. The focus keyword “DHA Karachi payment plans 2025” represents a broad spectrum – from official DHA installment schedules that make plot ownership feasible for the average buyer, to tailored bank loans that can turn a dream home into reality with manageable monthly payments. By understanding each option’s terms (and citing credible sources for the latest data), you can make an informed decision. DHA Karachi’s real estate, backed by its reputable name and Pakistan’s steady urban growth, offers a promising canvas for investors – just ensure your financial plan is as solid as the foundations of the home you aim to build.

For more, please visit

Sources: The information above for DHA Karachi Payment Plans 2025 has been compiled from official DHA Karachi announcements, credible real estate platforms, and banking institution resources. Key data on Indus Hills payment plans was referenced from the official DHA City Karachi Indus Hills brochureindushills.dhacitykarachi.org.pkindushills.dhacitykarachi.org.pk, and insights on new 2-year schemes and expected appreciations were drawn from real estate analysis in mid-2025propertypole.compropertypole.com. Details on developer projects (e.g. ARY Laguna, Burj Quaid, Phase 8 apartments) were obtained from project marketing materials and verified by property expertsirealprojects.comtheleadmarketing.com. For mortgage financing, current interest rates and terms were cross-checked with bank publications (Meezan Bank’s Easy Home financing offermeezanbank.commeezanbank.com) and economic reports indicating an easing monetary policy in 2025tribune.com.pk. Always consult the latest updates or a financial advisor for personalized advice, as market conditions can change. By staying informed and planning carefully, you can confidently navigate DHA Karachi’s 2025 payment plans to make a sound investment in your future.

Join The Discussion