Ground Data · Builder Insights · Real ROI Forecasts

🏙️ Introduction — From Speculative Boom to Smart Building Era (DHA Karachi Property Market Trends)

Over the past two years, DHA Karachi’s real estate market has completely reinvented itself.

What once thrived on quick flipping, rumor-based appreciation, and under-table deals is now driven by data, rental yield, and builder economics.

Between 2023 and 2025, Pakistan’s economic reality — high inflation, currency fluctuation, and record interest rates — forced investors to rethink how they view property.

The result? A clear transformation from speculative trading to project-based income investments.

Builders now talk in ROI, not square yards.

Overseas Pakistanis now seek steady yield instead of “plot doubling” dreams.

And for the first time, DHA Karachi has become a real market — where return is measurable, not emotional.

This comprehensive report — created by the ApnaDHA Market Research Desk — reveals how the market evolved, where profits lie, and what investors should expect in 2026.

📈 1. 2023 → 2025: The Shift from Speculation to Yield

The change didn’t happen overnight.

In 2023, DHA Karachi was struggling — inflation outpaced property appreciation, bank financing dried up, and builders paused projects.

But by mid-2024, a silent restructuring began:

| Segment | Avg Price (2023) | Avg Price (2025) | Change (%) | Key Trend |

|---|---|---|---|---|

| Residential Plots (500 yd) | ₨ 95M | ₨ 108M | +13.6% | Slower, genuine buyers only |

| Luxury Bungalows (500 yd) | ₨ 130M | ₨ 155M | +19% | End-user & overseas demand |

| Apartments (Clifton / DHA) | ₨ 25M | ₨ 33M | +32% | Rental yields driving prices |

| Commercial Plots (200 yd) | ₨ 150M | ₨ 180M | +20% | Builders dominating |

| DHA City Karachi (500 yd) | ₨ 5.8M | ₨ 7.2M | +24% | Early investors returning |

📊 Interpretation:

From 2023 to 2025, “sleeping plots” gave way to “earning properties.”

Apartments and commercial assets outperformed everything — because they produce monthly returns.

🏗️ 2. Phase-Wise Performance & Rental Trends (2025 Snapshot)

DHA Karachi isn’t one market — it’s multiple micro-markets shaped by zoning, roads, and construction permissions.

| Phase | Land Rate (₨ / yd²) | 2023→25 Growth | Avg Rent (₨/sq ft) | Rental Yield (Net) | Market Character |

|---|---|---|---|---|---|

| Phase 8 (Zone A–E) | 1.25–1.50M | +18% | 380–450 | 11–13% | Builder-led, brand retail |

| Phase 6 (Shahbaz/Rahat) | 950k–1.1M | +14% | 320–400 | 8–9% | Clinics, salons, offices |

| Phase 7 Ext. | 600k–750k | +11% | 250–300 | 10–11% | Builder homes |

| Phase 4 | 850k–950k | +9% | 240–280 | 9–10% | Family market |

| DHA City Karachi | 140k–180k | +24% | — | — | Long-term speculative |

🧭 Phase Analysis:

- Phase 8: Heart of commercial construction boom.

- Phase 6: Rental hotspot for medical & service offices.

- Phase 7 Ext: Still undervalued for builders.

- DHA City: The future “affordable DHA.”

💼 3. Builder Sentiment Report (ApnaDHA Builder Network – Q1 2025)

In January 2025, ApnaDHA surveyed 82 active DHA builders from Phases 6, 7, 8 & DHA City.

The results confirm the shift toward sustainable, build-to-earn models:

| Question | Most Common Answer | % of Respondents |

|---|---|---|

| What’s your next project type? | Commercial Plaza (200 yd, G+4+B) | 41% |

| What gives the best ROI? | Old House Rebuilds | 28% |

| Which area is most profitable? | Phase 8 (Zone D/E) | 21% |

| What’s the safest 5-year investment? | DHA City | 10% |

🧩 Observation:

Builders prefer shorter project cycles (under 18 months), aiming for a complete construction, rental, and exit within 2 years.

💰 4. ROI-Based Market Segmentation (2025 Overview)

| Asset Type | Avg Capital Required (₨) | Monthly Income (₨) | Net ROI (2025) | Risk Profile | Liquidity |

|---|---|---|---|---|---|

| 500 yd Bungalow | 150M | 450k | 3–4% | Low | Medium |

| Apartment (3-Bed, Clifton) | 30M | 230k | 9–10% | Medium | High |

| 200 yd Commercial Plaza | 230M | 2.9M | 12–13% | Medium | Medium |

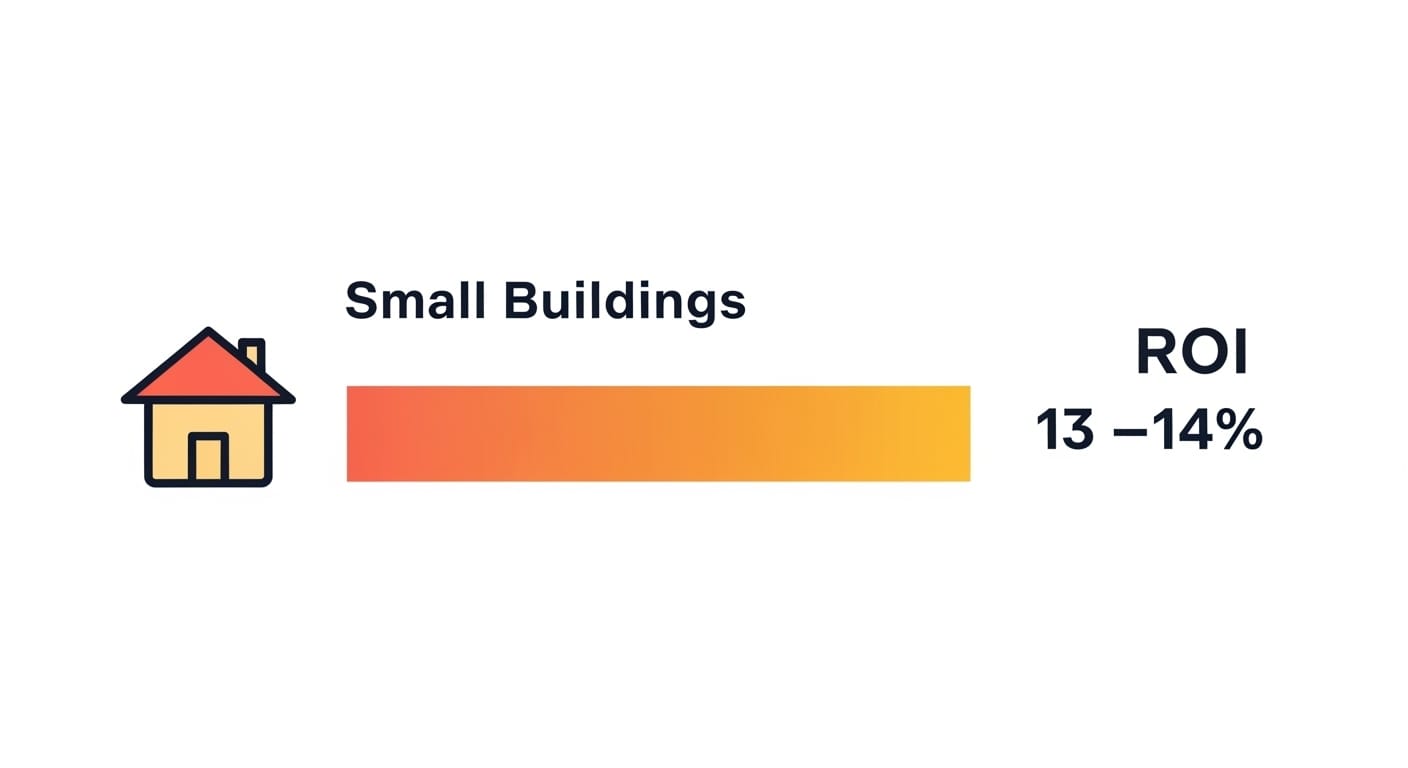

| 100–150 yd Mixed Building | 35M | 380k | 13–14% | High | High |

| DHA City Plot (Hold) | 7M | — | 0% (appreciation only) | Low | Low |

💡 Key takeaway: The “ROI triangle” is now clear — Apartments → Small Buildings → Commercial Plazas dominate short- to mid-term returns.

Read our complete DHA Karachi Investment Strategy 2026 — Smart Builder Moves & Market Forecast to discover phase-wise opportunities, ROI insights, and the future roadmap for DHA property investors.

🧱 5. The New Asset Classes Driving DHA 2025

🏡 A. Old House Rebuilds — Safe 20–25% Margins

A Phase 6 investor buying a 20-year-old house at ₨ 105M can rebuild for ₨ 22M and sell within 12 months for ₨ 150M.

✅ Profit: ₨ 23M (≈22%)

✅ Cycle Time: 10–12 months

📎 Read Full Guide: Flip or Rebuild?

🏢 B. 200-Yard Commercial Plazas (G+4+B)

Builders who once flipped 500 yd houses now prefer income assets.

A 200-yd plaza on Shahbaz or Ittehad costs ₨ 230M total, rents ₨ 2.9M/month, and returns 12.6% net.

| Variable | Value (₨) |

|---|---|

| Land | 170,000,000 |

| Construction | 58,500,000 |

| Soft Costs | 7,600,000 |

| Total Cost | 236,000,000 |

| Annual NOI | 29,700,000 |

| ROI | 12.6% |

🏘️ C. Apartments — The Urban Cashflow Model

Phase 8 and Clifton’s older complexes (Creek Vista, Reef Tower, Nishat Commercial) are being upgraded and re-rented for 8–10% yield.

Investors prefer them for:

- Quick liquidity

- Lower maintenance

- Corporate tenants

- FBR-declared income tax clarity

📎 See Full Blog → Apartment Value-Add ROI 2025

🧱 D. Small Mixed Buildings (100–150 yd)

The “builder-next-door” model now rules in Phase 2 Ext, 4, and 7 Ext —

Ground shops + 2 floors of offices or studios = ROI 13–14%.

Small capital, high turnover.

📎 Upcoming blog: Small Building Investment Model — DHA Karachi 2025.

📊 6. Comparative Rental Yield Chart (2025)

| Property Type | Net ROI (2023) | Net ROI (2025) | Change | Performance |

|---|---|---|---|---|

| Luxury Homes | 4.5% | 3.5% | ↓ -1% | Weak |

| Apartments | 6.8% | 9.5% | ↑ +2.7% | Strong |

| Commercial Plazas | 8.5% | 12.6% | ↑ +4.1% | Excellent |

| Small Buildings | 11.0% | 13.5% | ↑ +2.5% | Best Performer |

| DHA City Land | — | 10–12% (future) | ↑ | Long-term play |

📈 In just two years, income-producing assets gained 40–60% more investor attention than static plots.

🧮 7. Case Studies — Real Returns from DHA Builders

Case Study 1: The Old House Flipper

- Area: Phase 6

- Investment: ₨ 105M + 22M

- Sale: ₨ 150M

- ROI: 22% in 11 months

🧾 “Finishing cost controls your profit margin — marble, wood, and design decide resale speed.”

Case Study 2: The Commercial Developer

- Project: 200 yd Shahbaz Plaza (G+4+B)

- Cost: ₨ 236M

- Rent: ₨ 2.9M/month

- ROI: 12.6%

🧾 “The same land that gave 3% rent in 2020 now gives 12% — that’s real asset maturity.”

Case Study 3: The Apartment Investor

- Area: Clifton Block 8

- Cost: ₨ 28M + 2.2M renovation

- Rent: ₨ 230k/month

- ROI: 9.8%

🧾 “Corporate tenants now pay premium for ready-furnished apartments with smart lighting.”

🧾 8. Taxation, Policy & Bylaw Environment (2025)

| Regulation | Update / Rate | Impact |

|---|---|---|

| Capital Gains Tax | 3-year sliding: 10 → 5 → 0% | Encourages 3-year hold |

| Rental Income Tax | Final 10% | Predictable for investors |

| DHA Transfer Fee | 3.5% | Discourages short flips |

| Building Height Policy | G+4+B (200 yd+) | Boosts rental area |

| Fire & Parking NOCs | Strict | Raises build quality |

| FBR Track & Trace (2025) | Digitized | Improves documentation |

💡 DHA’s FAR policy (1:5) + improved digital transparency = professionalized market.

🌆 9. DHA City Karachi — The Next 5-Year Story

While main DHA areas focus on ROI, DHA City Karachi is the growth engine for 2026–2030.

- Possession Ratio: 35% and rising

- Sectors livable: 3, 5, 6, 9, 11

- 500 yd plots: ₨ 6.8M – ₨ 7.5M (still undervalued)

- Infrastructure: 90% roads in Zone B completed

- Key trigger: DHA Medical City & Karachi–Hyderabad M9 access

Projected price growth (2025–2030): +70–90%

📈 For long-hold investors, DHA City offers the only opportunity in Karachi where “land value < replacement cost.”

🔮 10. 2026 Market Forecast — What’s Next?

| Segment | 2025 ROI | 2026 Expected ROI | Price Trend 2026 | Comment |

|---|---|---|---|---|

| Luxury Bungalows | 3–4% | 4–5% | Stable | Stable market |

| Apartments | 9–10% | 10–11% | +5–8% | Consistent performer |

| Commercial Plazas | 12–13% | 13–14% | +7–10% | High rent growth |

| Small Buildings | 13–14% | 12–13% | +6% | Moderate |

| DHA City Land | — | 10–12% | +10–15% | Strong long-hold |

🧭 Outlook Summary:

2026 will reward investors who maintain liquidity, build smarter, and focus on yield-generating zones — especially Phase 6 & 8 corridors.

🧩 11. Strategic Recommendations for 2025–26

- Build, Don’t Hold: Empty plots no longer yield — convert them into structures.

- Control Finishing Costs: Builders who plan materials early save 12–15% on profit margins.

- Diversify: Mix 1 rental property + 1 development project to balance risk.

- Stay Documented: DHA & FBR monitoring is digital — compliance is profit.

- Leverage ApnaDHA Tools: Feasibility Sheets, Cost Guides, Agent Lounge.

🌐 12. External References

- Zameen Karachi Property Index (2023–2025)

- State Bank Monetary Policy Bulletin (Feb 2025)

- DHA Karachi Building Control Bylaws 2020 (Amendments 2024)

- Karachi Chamber of Commerce Market Report (2025)

- FBR Circular: Real Estate Valuation Tables 2025

🧭 13. ApnaDHA Internal Cluster Links

- Construction Cost per Sq Ft — DHA Karachi (2025 Guide)

- Old House Flip / Rebuild ROI Guide 2025

- Apartment Value-Add ROI — Clifton 2025

- Commercial Plaza Feasibility (Basement + G+4 2025)

- Electrical & Finishing Cost Guides 2025

🏁 14. Conclusion — 2025 Belongs to Smart Builders

DHA Karachi has matured into Pakistan’s most data-driven real estate ecosystem.

Every decision — from plot purchase to builder material choice — now links back to ROI.

2023–24: Confusion & correction.

2025–26: Calculation & consolidation.

Key facts to remember:

- Apartments are the fastest-growing yield asset (9–10%)

- 200 yd plazas deliver 12–13% net ROI

- Small mixed buildings bring 13–14% short-cycle return

- DHA City remains the best 5-year bet for 2026–30

📊 In short: Karachi’s property market has finally matured.

The investor who learns to calculate — not speculate — will dominate 2026.

For verified data, builder feasibility templates, and real-time ROI tools:

📍 Visit ApnaDHA.com

📲 WhatsApp: 0331-8208177 | Email: info@apnadha.com

💬 Join the Agents Lounge — Pakistan’s first social network for DHA professionals.

ApnaDHA — Pakistan’s DHA Real Estate Intelligence Platform

Join The Discussion