Intro: DHA Karachi Transfer Process

DHA Karachi is Pakistan’s most prestigious and well-regulated real estate community. One of its strongest features is a transparent, secure, and streamlined property transfer system. Whether you’re buying a residential plot, selling a luxury bungalow, or transferring ownership as a gift or inheritance, DHA’s strict documentation and biometric verification process ensure that ownership rights are fully protected.

This guide gives you everything you need to complete a property transfer confidently in DHA Karachi:

✅ A clear step-by-step transfer workflow

📄 A full checklist of documents for buyers and sellers

💰 The latest 2025 transfer fee structure, taxes, and charges

🔏 Rules for gift, inheritance, and overseas POA transfers

⚠️ Tips to avoid fraud and delays

🗂️ DHA Karachi Transfer Process Overview

DHA Karachi has established itself as a benchmark for secure property ownership in Pakistan. Its transfer system is fully digitized and monitored at the Transfer & Record Directorate.

Key Highlights :

- 🔒 100% Document Verification: All ownership papers are cross-checked with DHA records.

- 🖋️ Biometric Security: Buyer and seller must appear in person or use a valid embassy-attested Power of Attorney (POA).

- 🗂️ Central Digital Database: Every transaction is recorded to prevent title disputes.

- 🏢 Transfer Office Location: DHA Head Office, 2nd Street, Phase VIII, Karachi.

- 🕘 Timings: Monday–Friday, 9:00 AM–3:00 PM.

📋 Required Documents for Buyers & Sellers

🔑 Buyer’s Required Documents:

- Original CNIC + 2 photocopies

- 3 passport-size photographs

- NTN certificate (if filer)

- Bank draft/pay order for transfer fees, stamp duty, and taxes

- Updated contact and mailing address

🏠 Seller’s Required Documents:

- Original allotment or transfer letter

- CNIC copy

- 3 passport-size photographs

- Tax clearance certificate (if applicable)

- Paid utility bills (for built properties)

🧾 Special Cases:

| Transfer Type | Additional Documents Required |

|---|---|

| Gift (Hiba) | Gift deed & affidavit |

| Inheritance | Succession certificate & family tree |

| Power of Attorney (POA) | Registered POA (local or embassy attested) |

| Overseas Clients | NADRA NICOP & embassy attestation |

💡 Pro Tip: Prepare documents before token money exchange. A downloadable PDF checklist can save buyers and sellers time (embed mid-article).

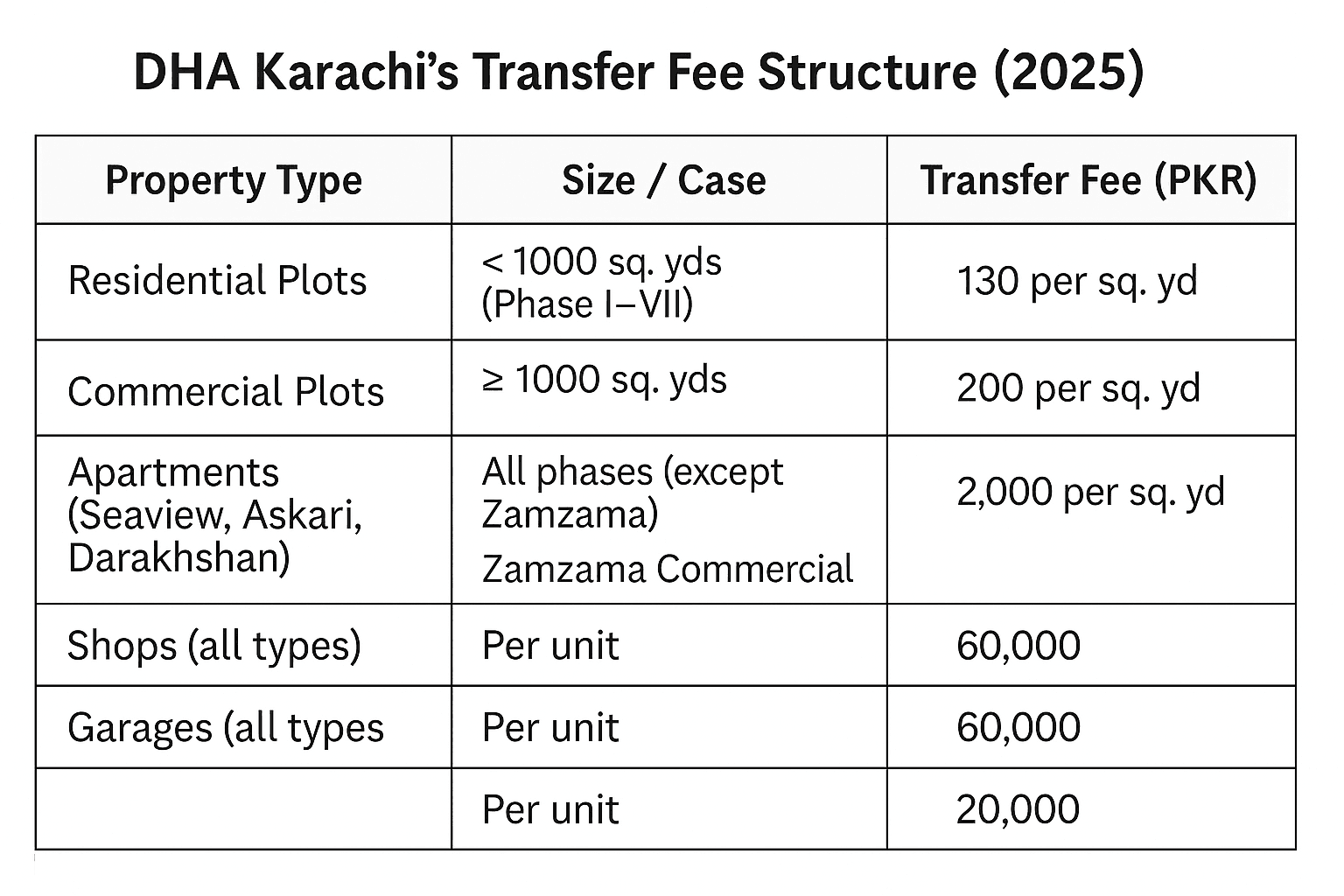

💰 DHA Karachi Transfer Process Fee Structure (2025)

Here’s the official fee chart extracted from DHA Karachi’s latest notification (PDF). Fees are calculated per square yard and vary by plot size, category, and property type:

🔹 Category A Members (Most Common)

| Property Type | Size / Case | Transfer Fee (PKR) |

|---|---|---|

| Residential Plots | <1000 sq. yds (Phase I–VII) | 130 per sq. yd |

| ≥1000 sq. yds | 200 per sq. yd | |

| Phase VIII C/D/E/E-8 | 100 per sq. yd | |

| Commercial Plots | All phases (except Zamzama) | 2,000 per sq. yd |

| Zamzama Commercial | 3,000 per sq. yd | |

| Apartments (Seaview, Askari, Darakhshan) | Per unit | 60,000 |

| Shops (all types) | Per unit | 60,000 |

| Garages (all types) | Per unit | 20,000 |

🔹 Category B Members (Higher Rate Highlights)

| Residential <1000 yds | 180 / sq. yd |

| Residential ≥1000 yds | 280 / sq. yd |

| Zamzama Commercial | 4,000 / sq. yd |

| Apartments | 132,000 / unit |

🔹 Corporate & Foreign Buyers

| Corporate Residential | 240–280 / sq. yd |

| Foreign Residential | 1,440 / sq. yd |

| Foreign Apartments | 360,000 / unit |

🔹 Gift (Hiba) Transfers

| Pakistani Residential | 60 / sq. yd |

| Foreign Residential | 720 / sq. yd |

| Apartments | 66,000–360,000 |

| Shops | 36,000–90,000 |

Download: Official DHA Karachi Transfer Fee Structure (PDF)

📌 Other Charges:

- Capital Gains Tax (Seller): Depends on holding period

- Advance Tax (Buyer): 2% (filer) / 4% (non-filer) of FBR/DC value

- Stamp Duty: 3% of FBR/DC value

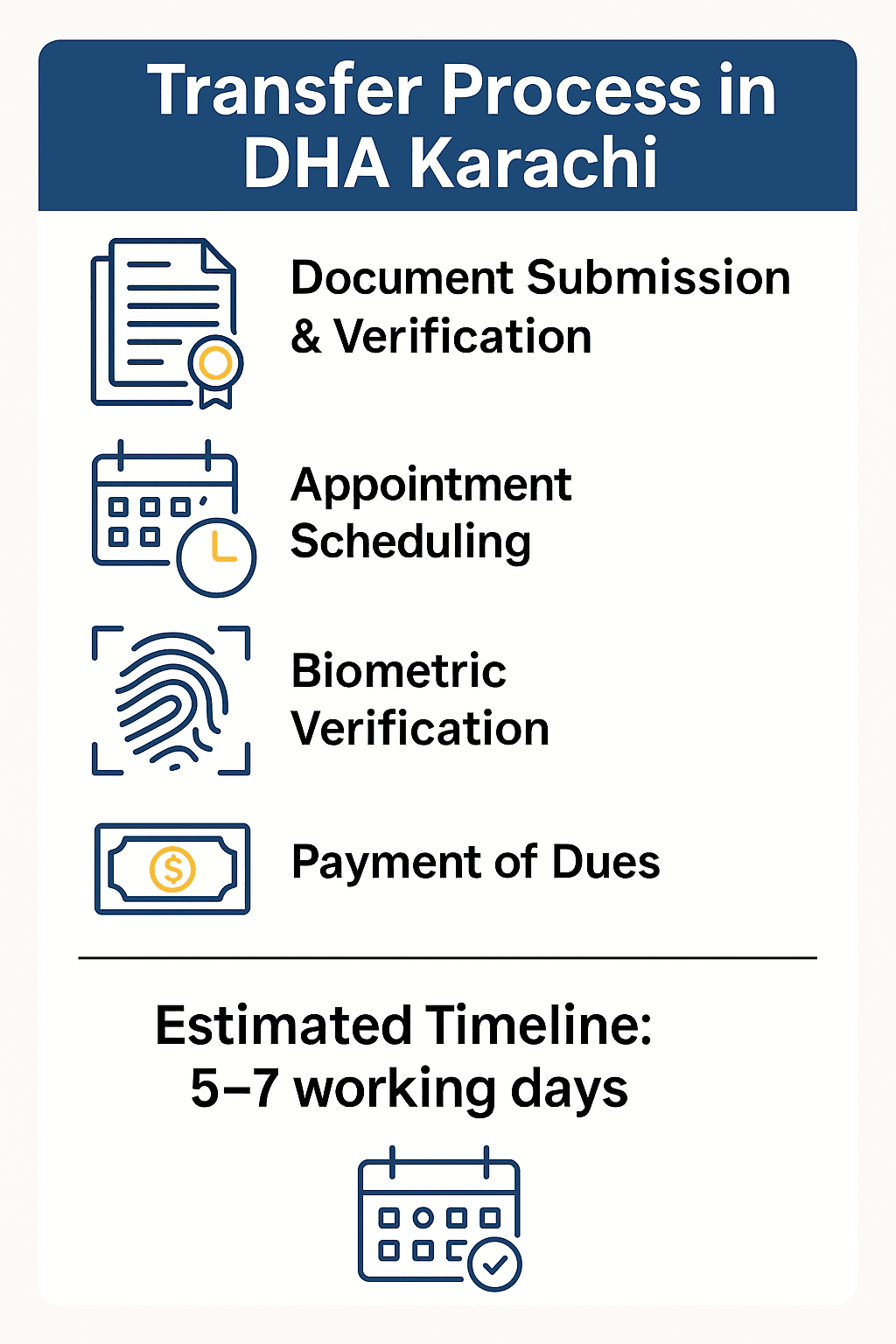

🔍 Step-by-Step DHA Karachi Transfer Process

Here’s the standard workflow followed in all DHA Karachi transactions:

- Document Submission & Verification: Submit all ownership documents at Transfer & Record Directorate. Verification takes 1–2 days.

- Appointment Scheduling: DHA issues a transfer appointment for both parties.

- Biometric Verification: Both buyer and seller appear for biometric authentication.

- Payment of Dues: Transfer fee, stamp duty, advance tax, and CGT are paid via bank draft.

- No Objection Certificate (NOC): DHA issues NOC after clearing all dues.

- Ownership Transfer: DHA executes transfer and issues a new transfer letter.

⏳ Estimated Timeline: 5–7 working days if documents are complete.

🎁 Gift, Inheritance & Power of Attorney Transfers

| Type of Transfer | Process Summary |

|---|---|

| Gift (Hiba) | Gift deed execution, affidavit, and biometric verification. |

| Inheritance | Requires succession certificate, death certificate, family tree verification. |

| Power of Attorney | Embassy attestation for overseas; registered POA for local. |

🏦 Bank & Mortgage-Linked Transfers

If property is financed:

- Obtain a Bank NOC confirming lien clearance.

- DHA verifies all loan settlement documents.

- Extra verification steps mean longer processing time.

⚠️ Mistakes to Avoid

- Paying token money without file verification.

- Not confirming seller’s tax clearance and utility bills.

- Ignoring biometric verification.

- Delaying stamp duty and tax payments.

🏘️ DHA Karachi Transfer Process vs Other Societies

| Feature | DHA Karachi | Clifton Cantonment | Bahria Town |

|---|---|---|---|

| Biometric Verification | ✅ Yes | ❌ No | ⚠️ Limited |

| Digital Records | ✅ Yes | ❌ No | ✅ Yes |

| Fraud Protection | 🔒 Strong | ⚠️ Moderate | ⚠️ Moderate |

| Transfer Timeline | 5–7 days | 7–15 days | 10+ days |

❓ Top FAQs (SEO + AEO Optimized)

Q1: How long does a DHA Karachi transfer take?

Typically 5–7 working days, depending on documentation and dues clearance.

Q2: Can I transfer property while overseas?

Yes, using an embassy-attested POA.

Q3: How much is the transfer fee for a 500-yard plot?

Approx. PKR 90,000 (Category A), plus taxes.

Q4: What taxes apply to buyers and sellers?

- Seller: Capital Gains Tax (based on holding period).

- Buyer: Advance Tax (2% filer / 4% non-filer).

Q5: Are gift transfers cheaper?

Yes, gift transfer fee is PKR 60/sq. yd for Pakistani citizens.

📞 Need Help with DHA Karachi Transfers?

Let our verified agents handle the hassle for you:

✅ Fast document verification

✅ Accurate fee calculation

✅ Smooth, secure process

📲 WhatsApp: 0321-8286664

🌐 Visit: ApnaDHA.com

Join The Discussion