🏙️ Introduction — The New Goldmine in DHA Karachi (200 Sq Yards Commercial Building in DHA Karachi (G+4+B) Feasibility 2025)

As DHA Karachi enters 2025, a clear trend is emerging:

small builders are earning big — not through residential bungalows, but through compact commercial projects on 200-yard plots.

DHA’s updated building regulations now allow Basement + Ground + 4 Floors (G+4+B) on most commercial avenues such as Khayaban-e-Shahbaz, Kh-e-Ittehad, Rahat, Bukhari, Tauheed, and Phase 8 zones.

This change has completely transformed the profitability of small-scale development.

A plot that once supported a 5,000 sq ft structure (G+2) can now generate 9,000–10,000 sq ft of rentable space — effectively doubling yield.

In this ApnaDHA feasibility report, we’ll calculate:

- Real 2025 construction & rent figures

- ROI, yield, and payback analysis

- Cost per sq ft with basement inclusion

- Phase-wise comparison

- Legal checklist (DHA bylaws 2020–24)

🧱 1. Market Overview — DHA Karachi’s Commercial Transition

The post-COVID property cycle shifted investor focus from speculative plots to income-generating retail buildings.

Rising interest rates, high land inflation, and stable commercial rents have made small plazas the preferred portfolio choice for both builders and end-investors.

| Phase / Location | Land Price (₨ / sq yd) | Rent (₨ / sq ft / mo) | ROI (Gross) | Demand Profile |

|---|---|---|---|---|

| Shahbaz Commercial | 1.0 – 1.2 mn | 350 – 420 | 8–9 % | Premium retail & clinics |

| Ittehad Commercial | 1.2 – 1.3 mn | 400 – 450 | 8–10 % | Brand outlets & offices |

| Bukhari Commercial | 850 k – 950 k | 250 – 400 | 7–8 % | Boutiques, salons, interior |

| Badar / Rahat | 900 k – 1.0 mn | 280 – 350 | 8–9 % | Service businesses |

📈 Trend: Commercial rentals have grown 12–15% in two years — while new FAR permissions have unlocked stronger project feasibility.

🧮 2. Updated Construction Feasibility — G+4 + Basement (2025 Rates)

| Parameter | Value (₨) | Notes |

|---|---|---|

| Land Size | 200 sq yd (1,800 sq ft) | Standard DHA commercial |

| Permissible Floors | Basement + G + 4 | FAR ≈ 1:5 |

| Total Built-up Area | 9,000 – 9,500 sq ft | Including basement |

| Land Cost | 170,000,000 | Prime frontage |

| Construction Cost | 6,500 / sq ft | High-spec commercial |

| Total Construction | 9,000 × 6,500 = 58,500,000 | RCC + MEP + Finishing |

| Soft Costs (8%) | 4,680,000 | Architect + approvals |

| Contingency (5%) | 2,925,000 | Inflation buffer |

| Total Project Cost | 236,105,000 (≈236 mn) | Land + build + soft |

(Cross-ref: Construction Cost per Sq Ft in DHA Karachi (2025))

🏢 3. Rent Potential by Floor (2025 DHA Market Benchmarks)

| Level | Area (sq ft) | Rent (₨ / sq ft) | Monthly Rent (₨) | Tenant Type |

|---|---|---|---|---|

| Basement | 1,800 | 200 | 360,000 | Gym, storage, studio |

| Ground Floor | 1,800 | 420 | 756,000 | Café / retail outlet |

| Mezzanine | 900 | 300 | 270,000 | Salon / clinic |

| 1st Floor | 1,800 | 270 | 486,000 | Corporate office |

| 2nd Floor | 1,800 | 250 | 450,000 | IT firm / coworking |

| 3rd Floor | 1,800 | 230 | 414,000 | Startup or training |

| 4th Floor | 900 | 200 | 180,000 | Small agency / studio |

| Total | 10,800 | — | 2,916,000 / month | — |

Gross Annual Rent: PKR 35.0 million

Operating Expenses (15%): PKR 5.25 million

Net Operating Income (NOI): PKR 29.75 million

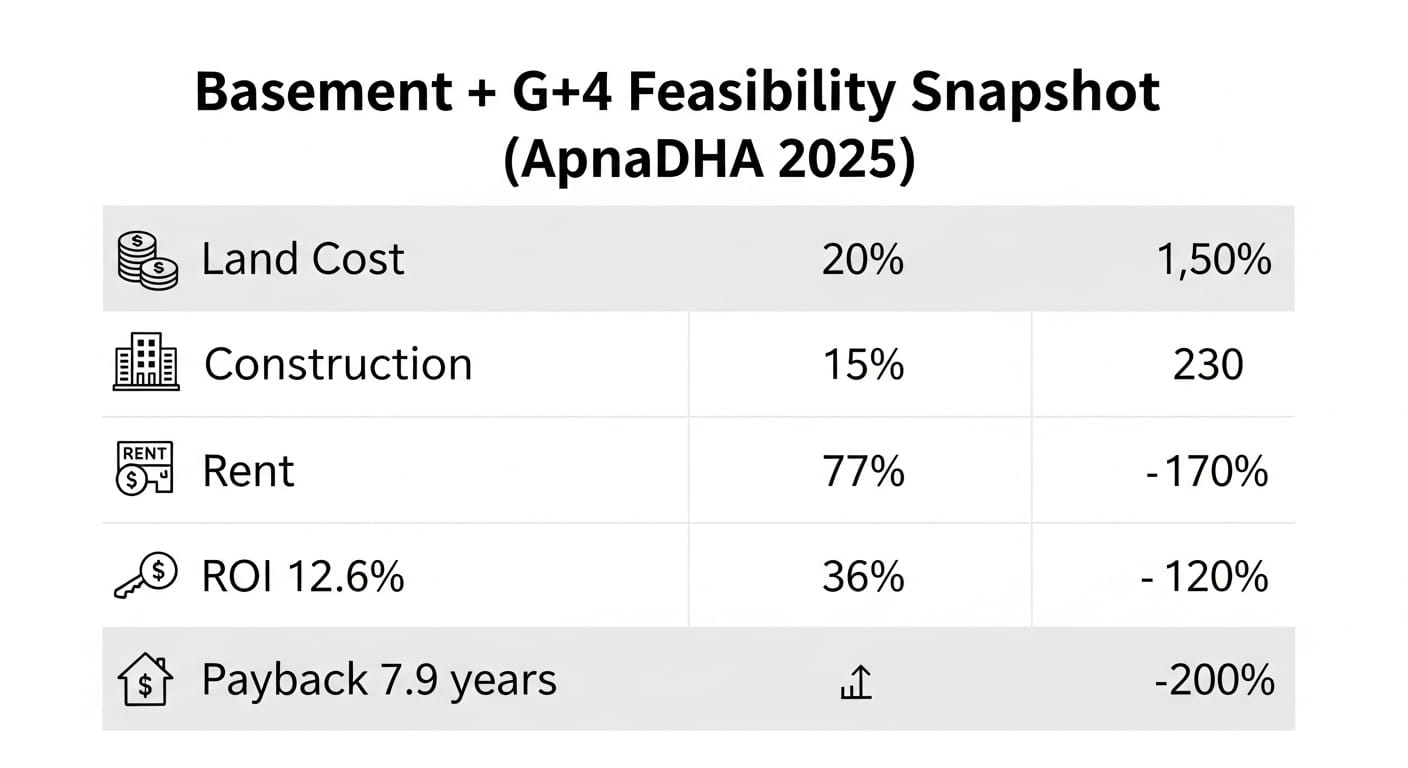

➡ ROI = 29.75 / 236 = 12.6 %

➡ Payback = 7.9 years

🧩 4. ROI Scenarios (Based on Market Shifts)

| Scenario | Rent Change | NOI (₨ mn) | ROI % | Payback |

|---|---|---|---|---|

| Base Case | — | 29.7 | 12.6% | 7.9 yrs |

| Optimistic (+10% Rent) | +10% | 32.6 | 13.8% | 7.2 yrs |

| Conservative (–10% Rent) | –10% | 26.8 | 11.3% | 8.8 yrs |

📊 Even in a conservative rental dip, yield stays above 11% — higher than any residential investment.

📊 Want to understand the bigger picture?

Read our complete DHA Karachi Property Market Trends & Investment Guide (2025–26 Report) — covering ROI data, builder insights, and phase-wise market performance across DHA Karachi.

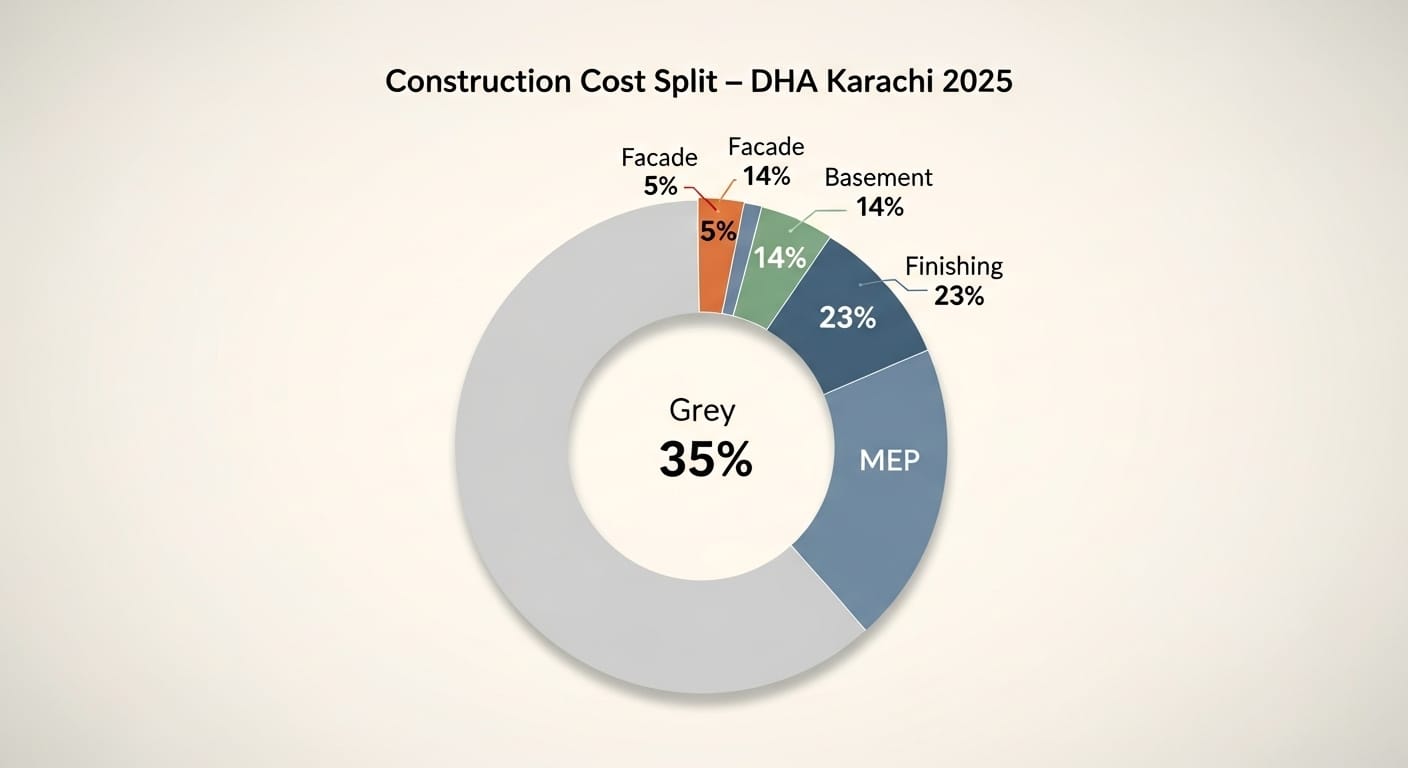

🧱 5. Construction Cost Breakdown (Basement + G+4)

| Category | Cost (₨ / sq ft) | % Share | Notes |

|---|---|---|---|

| Excavation + Raft + Basement | 900 | 14% | Waterproofing & sump system |

| RCC Structure | 2,100 | 32% | Slabs, columns, beams |

| MEP & Fire Systems | 1,500 | 23% | Electrical, HVAC, plumbing |

| Finishing (Tiles, Paint, Joinery) | 1,500 | 23% | Moderate-grade |

| Lift, Facade & Misc | 500 | 8% | ACP cladding + elevator |

| Total Average | 6,500 / sq ft | 100% | 2025 builder-verified |

🧾 6. Financing Scenario (Optional Debt Leverage)

| Parameter | Value |

|---|---|

| Bank LTV | 50 % (loan = 118 mn) |

| Rate (SBP Avg 2025) | 16 % |

| Annual Interest | 18.9 mn |

| DSCR (NOI ÷ Debt Service) | ≈ 1.57× |

🟢 Interpretation: Project comfortably supports moderate debt leverage if rental occupancy ≥ 85%.

(External ref: State Bank of Pakistan Monetary Policy 2025)

🧱 7. Location-Wise Rent & Demand Snapshot

| Zone | Average Rent (₨ / sq ft) | Demand | Tenant Type |

|---|---|---|---|

| Kh-e-Shahbaz (Phase 6) | 380 – 420 | High | Brands, Clinics |

| Kh-e-Ittehad (Phase 8) | 400 – 450 | Very High | Cafés, Banks |

| Tauheed / Bukhari | 250 – 320 | Medium | Salons, Offices |

| Rahat / Badar | 280 – 350 | Medium | Agencies, Boutiques |

| DHA Phase 8 Ext. | 300 – 370 | Rising | Food & showrooms |

💡 Phase 6 plots lease faster; Phase 8 yields higher rent/sq ft.

Read our complete DHA Karachi Investment Strategy 2026 — Smart Builder Moves & Market Forecast to discover phase-wise opportunities, ROI insights, and the future roadmap for DHA property investors.

⚙️ 8. Key Compliance Checklist (DHA Bylaws 2020–24)

- FAR: 1:5 for 200 yd (Basement + G + 4)

- Height Limit: Up to 65 ft from crown level

- Parking: 1 car / 400 sq ft (or mechanical system allowed)

- Fire NOC: Mandatory for >G+2

- Basement Use: Storage, gym, parking, or office — not retail

- Completion Certificate: DHA must inspect MEP + safety prior to leasing

🧾 9. Comparative Feasibility (G+2 vs G+4+B)

| Model | Built-up (sq ft) | Total Cost (₨ mn) | Rent (₨ mn/yr) | ROI % |

|---|---|---|---|---|

| G+2 (Old Bylaw) | 5,400 | 208 | 16.8 | 8.1 % |

| G+4+B (New Bylaw) | 9,000 | 236 | 29.7 | 12.6 % |

🚀 That’s a 56% increase in area, and nearly 50% jump in yield — on the same land.

📈 10. Exit Strategy Options for Builders

A. Hold-for-Rent

- Steady 12–13% annualized return

- Asset appreciates ~4–6% annually

- Ideal for long-term portfolios

B. Sell Floors Individually

| Floor | Market Rate (₨ / sq ft) | Revenue (₨ mn) |

|---|---|---|

| Ground + Mezzanine | 70,000 | 27.0 |

| 1st + 2nd Floor | 55,000 | 19.8 |

| 3rd + 4th Floor | 45,000 | 16.2 |

| Total | — | 63.0 mn + rent |

Profit Margin (post cost recovery) ≈ 14–16%

C. Hybrid Model

- Lease ground & mezzanine → regular cash flow

- Sell upper floors to recover capital

- Maintain brand visibility & ownership

🧠 11. Risk Matrix (2025–26 Outlook)

| Risk | Impact | Mitigation |

|---|---|---|

| Build cost inflation | Medium | Lock BOQ early |

| Rent softening (oversupply) | Low | Choose Phase 6/8 only |

| Seepage in basement | High | Waterproof membrane + sump |

| Delay in approvals | Medium | Use DHA-approved architect |

| Weak maintenance | Medium | Add 5% rent reserve fund |

🧩 12. Internal ApnaDHA References

- Construction Cost per Sq Ft in DHA Karachi (2025 Guide)

- Old Houses in DHA Karachi — Flip or Rebuild (2025 ROI Guide)

- Apartment Renovation ROI — DHA Clifton 2025

- Builder Directory — Commercial Project Experts

- Agents Lounge — List or Lease Commercial Units

🌐 13. External Industry References

- DHA Karachi Building Control Bylaws 2020 (Commercial FAR Amendments 2023–24)

- State Bank of Pakistan Policy Bulletin 2025

- Zameen.com Commercial Rent Index Q1 2025

- Karachi Chamber of Commerce Property Review 2024

🧮 14. Feasibility Summary (Final Numbers – G+4+B Model)

| Component | Value (₨) |

|---|---|

| Land | 170,000,000 |

| Construction | 58,500,000 |

| Soft + Contingency | 7,600,000 |

| Total Investment | 236,000,000 |

| Gross Annual Rent | 35,000,000 |

| NOI (Net) | 29,700,000 |

| ROI | 12.6 % |

| Payback Period | 7.9 years |

🏁 Conclusion — The 200-Yard DHA Power Model

In the current market, Basement + G+4 construction has redefined small-plot profitability in DHA Karachi.

The same 200-yard parcel that once earned 8% yield can now produce 12–13% net return — safely, sustainably, and with steady demand.

Investor Snapshot:

- ✅ Total Investment: PKR 236 million

- ✅ Net Income: PKR 29.7 million/year

- ✅ Payback: 7.9 years

- ✅ Long-term Appreciation: 4–6% annually

The 200-yard commercial project is no longer a small play — it’s the new “builder’s retirement plan” for DHA investors.

📥 Download: Commercial Feasibility Excel (Basement + G+4)

📲 WhatsApp: 0331-8208177 for a site-specific analysis.

ApnaDHA — Pakistan’s DHA Real Estate Intelligence Platform.

Join The Discussion