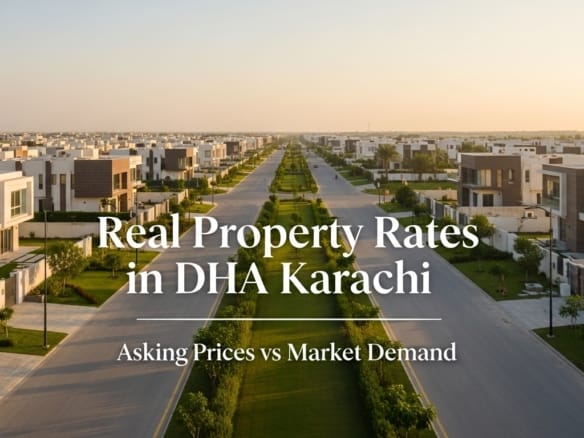

Why Most Buyers Chase Cheap — and Regret It Later

Introduction: Cheap Property and Smart Deal

Every property buyer wants a good deal.

And most buyers believe a cheap property = smart decision.

That assumption is where problems begin.

In markets like DHA Karachi, buyers often confuse low price with high value.

As a result, many buyers feel excited on purchase day — and frustrated six months later.

This guide explains, clearly and honestly, the real difference between a cheap property and a smart deal — and how serious buyers protect themselves from costly mistakes.

Many buyers confuse cheap pricing with opportunity. In reality, a smart deal is usually connected to timing, seller motivation, and real demand — not weak fundamentals.

To understand this concept more deeply, buyers should clearly know what is a chance deal in the property market and how genuine opportunities are identified before they become public.

Table of Contents

- Why Most Buyers Chase Cheap — and Regret It Later

- Introduction: Cheap Property and Smart Deal

- What Buyers Mean When They Say “Cheap Property”

- What a Smart Deal Actually Means

- Cheap Property vs Smart Deal (Side-by-Side Reality)

- Why Cheap Properties Stay Cheap

- The Demand Test (Most Buyers Ignore This)

- How Smart Buyers Think Differently

- Why Most “Cheap Deals” Are Pushed Aggressively

- The Hidden Cost of Buying Cheap

- Smart Deal = Slightly Below Real Market Value

- Where Smart Deals Usually Come From

- Live Smart Opportunities (High-Intent Section)

- Cheap vs Smart: The One-Line Rule

- Frequently Asked Questions (AEO Optimized)

- Final Thoughts: Price Is Temporary, Demand Is Permanent

What Buyers Mean When They Say “Cheap Property”

When buyers say cheap, they usually mean:

- Lower price than what they expected

- Below advertised market rates

- “Bargain” compared to WhatsApp listings

But cheap is a price comparison, not a value judgment.

A property can be cheap for the wrong reasons.

What a Smart Deal Actually Means

A smart deal is not about being the cheapest.

It is about being correctly priced for its demand, risk, and future exit.

A smart deal:

- Makes sense today

- Still makes sense after 3–5 years

- Has buyers when you want to sell

- Protects your capital

- Does not rely on hype

👉 Smart deals survive time. Cheap deals often don’t.

Cheap Property vs Smart Deal (Side-by-Side Reality)

Cheap Property

- Weak or declining demand

- Poor resale liquidity

- Location compromises

- Seller flexibility due to lack of buyers

- Long holding periods

- Emotional pricing advantage only

Smart Deal

- Real buyer demand

- Acceptable or strong location

- Clean exit potential

- Slight discount due to timing or motivation

- Fast absorption

- Logical pricing, not emotional

The difference is not the price — it’s the demand behind the price.

Why Cheap Properties Stay Cheap

One of the biggest buyer mistakes is assuming:

“Ab sasta hai, baad mein mehnga ho jayega.”

In reality, many properties stay cheap because:

- End-users don’t want to live there

- Investors can’t exit easily

- Infrastructure growth is slow

- Inventory is excessive

- Demand never materializes

Low price without demand is not opportunity — it’s risk.

The Demand Test (Most Buyers Ignore This)

Before buying anything, smart buyers ask one question:

“Agar main yeh property bechna chahoon, khareednay wala kaun hoga?”

Cheap properties often fail this test.

Smart deals pass because:

- Someone else also wants them

- Not just because they’re cheap

- But because they make sense

How Smart Buyers Think Differently

Smart buyers do not ask:

❌ “Kitni sasti mil rahi hai?”

They ask:

- Is demand real or artificial?

- Is the price aligned with recent executed deals?

- Who is the next buyer?

- What happens if I need to exit early?

This mindset alone separates investors from regretters.

Why Most “Cheap Deals” Are Pushed Aggressively

Notice a pattern?

Cheap properties are often:

- Broadcast loudly

- Repeated daily

- Pushed with urgency

- Compared to unrealistic prices

Smart deals behave differently:

- Limited circulation

- Quiet sharing

- Quick closures

- No hype needed

Real value doesn’t need shouting.

The Hidden Cost of Buying Cheap

Cheap properties often cost more later through:

- Longer holding periods

- Poor resale value

- Opportunity loss

- Capital lock-in

- Emotional stress

What looks cheap on paper can become expensive in real life.

Smart Deal = Slightly Below Real Market Value

This is important.

A smart deal is usually:

- Slightly below real market value

- Not dramatically cheaper

- Supported by logic, not desperation

Extreme discounts almost always signal structural weakness.

Where Smart Deals Usually Come From

Smart deals exist because of:

- Timing

- Seller motivation

- Clean urgency

- Off-market situations

They do not exist because:

- “Market crash aa rahi hai”

- “Owner majboor hai” (without proof)

- “Last price hai” claims

Live Smart Opportunities (High-Intent Section)

Below are current smart-deal-category properties that meet real demand and exit criteria.

Availability is limited and changes quickly.

🔹 Featured Smart Deal 1

[Property Title – Phase / Size / Type]

- Demand-driven location

- Clean documentation

- Correct pricing logic

👉 View full details

🔹 Featured Smart Deal 2

[Property Title – Phase / Size / Type]

- End-user friendly

- Limited inventory zone

👉 View full details

📌 (You can dynamically pull properties here from your website category: “Smart Deals / Chance Deals”)

Cheap vs Smart: The One-Line Rule

If a property is cheap because nobody wants it, it will remain cheap.

If a property is smart because people want it, it will move.

Frequently Asked Questions (AEO Optimized)

Is buying cheap property a good investment?

Only if cheap pricing is backed by real demand. Otherwise, it increases exit risk.

What makes a property a smart deal?

Correct pricing, real buyer demand, clean exit potential, and logical motivation.

Why do smart deals close fast?

Because prepared buyers recognize value before it becomes public.

Are cheap properties always risky?

Not always — but most are cheap for structural reasons buyers ignore.

Final Thoughts: Price Is Temporary, Demand Is Permanent

Smart buyers don’t chase cheap.

They chase clarity.

A smart deal feels calm, logical, and explainable.

A cheap deal feels exciting — and often disappointing.

Expert Note

In real estate, value whispers — hype shouts.

Join The Discussion