From Old Structure to Modern Asset — Real DHA Karachi Numbers Explained

(ApnaDHA Research Desk, 2025 Edition)

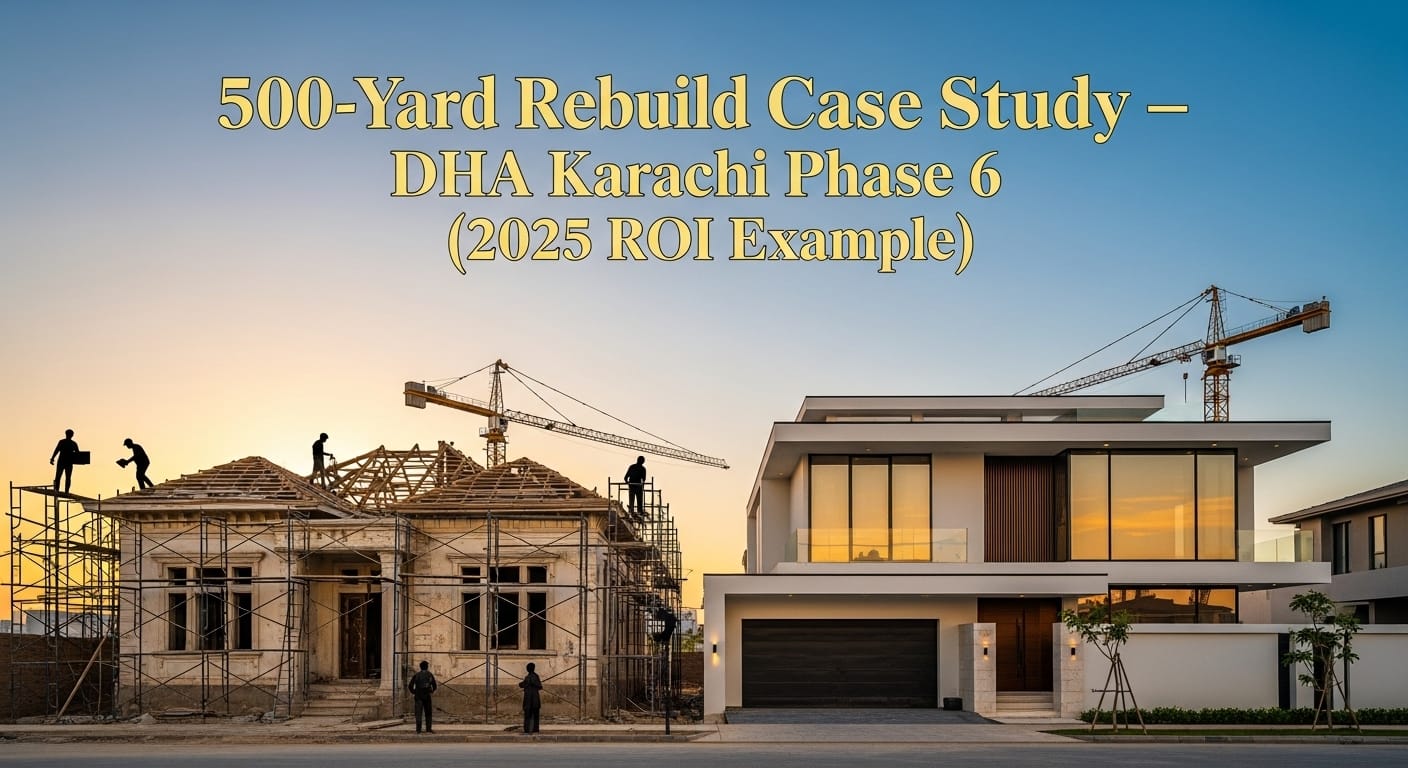

🏙️ Introduction — Why This Case Study Matters (Reliable Contractor in DHA Karachi)

Every day in DHA Phase 6, old 500-yard homes are being torn down and rebuilt.

But few investors actually track the math behind these projects — the real cost, timeline, resale gain, and ROI percentage.

This detailed ApnaDHA case study breaks down a realistic 500-yard rebuild project in Phase 6 (Rahat) — including before-and-after cost analysis, BOQ summary, builder challenges, and final profit calculation.

It’s designed to help builders and homeowners replicate this ROI model safely and smartly in 2025–26.

🧱 1. Project Overview — Phase 6 Rebuild Snapshot

| Detail | Data |

|---|---|

| Plot Size | 500 Square Yards |

| Location | Rahat Commercial Back Lane, DHA Phase 6 |

| Old House Age | 19 Years (Built 2005) |

| Old Structure Type | 2 Floors + Basement (weak RCC foundation) |

| Project Type | Full Demolition + New G+2 Rebuild |

| Total Timeframe | 13 Months |

| Project Lead | ApnaDHA Verified Builder |

| Goal | Sell Post-Rebuild / Investor Flip |

💣 2. Pre-Rebuild Evaluation (Old House Condition)

Before demolition, engineers noted:

- Cracks in load-bearing walls (settlement signs).

- Weak waterproofing in basement.

- Poor ventilation & small kitchen layout.

- Old plumbing using steel pipes causing rust stains.

- Outdated mosaic flooring and electrical junctions.

📉 Market Observation (Q1 2024):

Old 500-yd homes in Rahat averaged ₨ 200–220k/yd² — nearly 25% below market of new builds.

Before starting demolition or excavation, every builder must comply with the official DHA Karachi Building By-Laws to ensure structural safety and NOC approval.

🏗️ 3. Project Scope & Design

Objective:

Create a modern, energy-efficient, family-oriented house for upper-middle-class buyers.

Highlights of New Plan:

- 2-unit layout (Ground + First Floor separate entrances).

- 6 bedrooms + basement entertainment zone.

- Open kitchen with island.

- Skylight & smart lighting.

- Dual solar + grid backup.

- Car porch for 4 vehicles.

💡 Design Note: Architect used north-south orientation for cross-ventilation — crucial for Karachi’s humidity and resale appeal.

As illustrated in our Renovation vs Rebuild Cost in DHA Karachi (2025 Guide), full reconstruction consistently doubles long-term returns compared to surface-level renovations.

💰 4. Cost Breakdown (Actual 2025 Rates)

| Category | Estimated Cost (₨) | % of Total |

|---|---|---|

| Demolition + Waste Disposal | 1.5 M | 6 % |

| Grey Structure (RCC + Masonry) | 8.8 M | 35 % |

| Plumbing + Electrical | 3.5 M | 14 % |

| Finishing (Tiles, Paint, Ceiling) | 7.2 M | 29 % |

| Woodwork + Fixtures | 2.8 M | 11 % |

| Exterior + Landscaping | 1.5 M | 5 % |

| Total Build Cost | ₨ 25.3 Million | 100 % |

📎 Reference: Construction Cost per Sq Ft in DHA Karachi (2025 Guide)

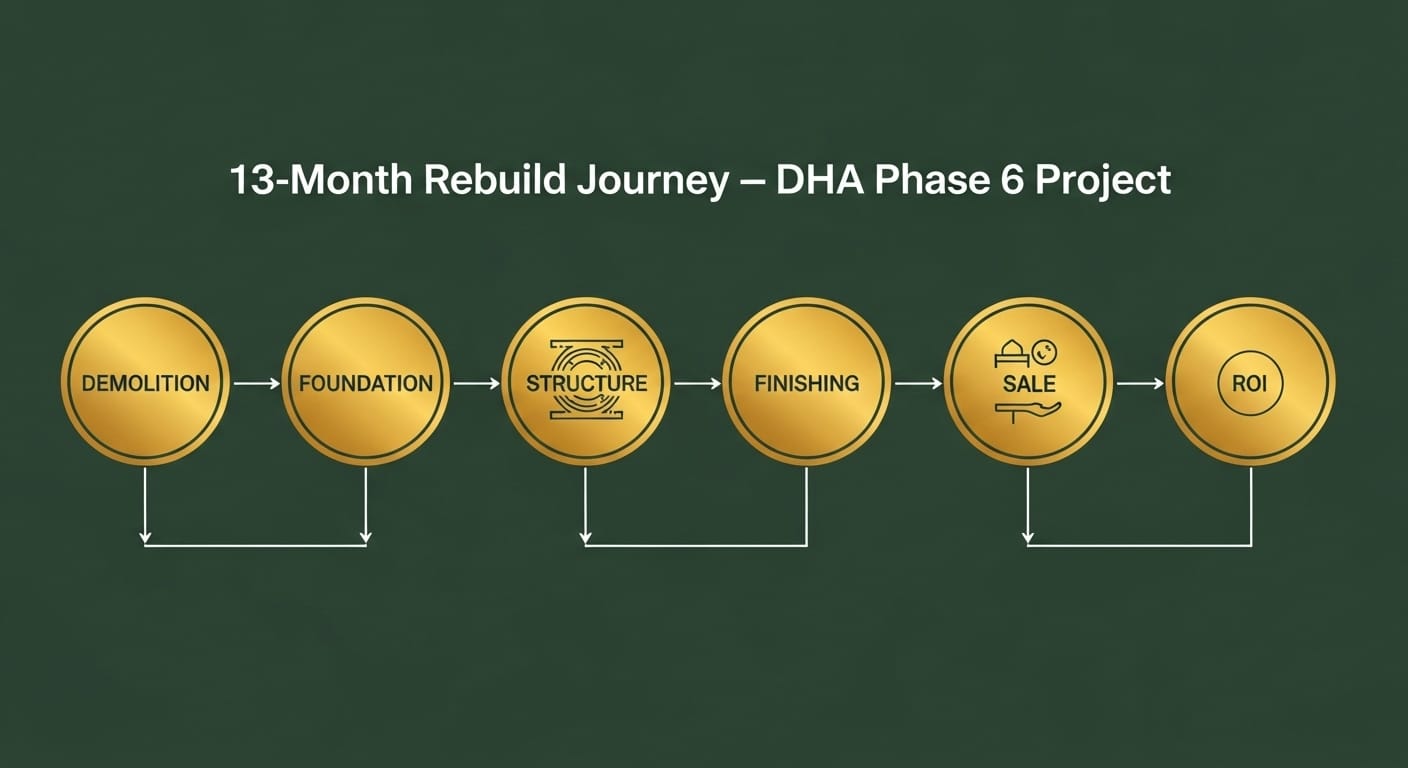

📆 5. Timeline Breakdown

| Stage | Duration | Notes |

|---|---|---|

| Demolition & NOC | 3 Weeks | Smooth DHA approval |

| Foundation + RCC | 2 Months | Excavation + steelwork |

| Masonry + Roof Work | 3 Months | 3 floors |

| Finishing + MEP | 4 Months | Imported tiles & Porta sanitary |

| Woodwork + Painting | 2 Months | Mix of ash & walnut |

| Final Touches + Handover | 1 Month | QA & cleaning |

💡 Total Project Duration: 13 Months (from plot clearance to sale listing)

The project avoided typical delay and cost overruns by following the exact procedures outlined in How to Choose a Reliable Contractor in DHA Karachi (2025 Checklist).

📊 6. Market Value Comparison

| Stage | Value (₨) | Change |

|---|---|---|

| Old House (Pre-Demo) | 105 M | — |

| Post Rebuild (New Structure) | 150 M | +45 M |

| Net Value Increase | — | ≈ 43% |

💬 ApnaDHA Realtor Insight:

“In Phase 6, new 2025 houses sell 25–30% faster and 40% higher than old 2000s structures — especially those built by branded teams.”

The project avoided typical delay and cost overruns by following the exact procedures outlined in How to Choose a Reliable Contractor in DHA Karachi (2025 Checklist).

💹 7. ROI Calculation

| Parameter | Value |

|---|---|

| Total Investment | ₨ 105 M (land) + ₨ 25.3 M (build) = ₨ 130.3 M |

| Final Sale Price | ₨ 150 M |

| Gross Profit | ₨ 19.7 M |

| Holding Period | 13 months |

| Net ROI | ≈ 15.1% in 1 year (post-tax) |

📎 Compare With: Renovation vs Rebuild Cost in DHA Karachi (2025 Guide)

🧾 8. Factors That Boosted Profit

✅ Efficient design (two-unit = dual buyer target).

✅ On-time completion (13 months vs average 16).

✅ Imported finishes (bath fittings, tiles).

✅ Documented contractor (DHA-approved).

✅ Open-plan layout & smart lighting package.

📊 Additional Bonus: Sold with 1-year maintenance warranty — added buyer confidence and 2% price edge.

⚙️ 9. Common Challenges

| Issue | Impact | Solution Used |

|---|---|---|

| Steel & cement price fluctuation | +8% cost increase | Pre-booked bulk material through supplier contract |

| Labor shortage during Eid season | 2-week delay | Brought backup crew from Phase 7 |

| Approval delay for solar plan | 10 days | DHA E&E Section coordination via ApnaDHA partner |

💡 Lesson: Always pre-plan utility NOCs (K-Electric, Solar, Gas) parallel to finishing stage.

For readers planning interior or electrical works, see our Electrical & Lighting Checklist for DHA Homes (2025 Finishing Guide) and the full House Finishing Cost in DHA Karachi (2025 Guide) for updated brand-wise cost comparisons.

🧱 10. Buyer Demand Pattern (2025–26)

| Buyer Type | Demand % | Preference |

|---|---|---|

| Overseas Pakistani Families | 40 % | Ready-to-move luxury finish |

| Local Business Owners | 30 % | 2-unit rental model |

| Builders / Investors | 20 % | Flip resale potential |

| Tenants (corporate) | 10 % | Lease options |

📈 Phase 6 Rebuilt Houses now command ₨ 280k–350k/month rent — among DHA’s top-performing zones.

🧩 11. Lessons for Builders

- Pre-book material to hedge inflation.

- Use ApnaDHA contractor checklist for supervision.

- Add small luxury touches (smart locks, warm lights).

- Design dual-entrance layout to attract both families & tenants.

- Never compromise on branded materials — resale buyers verify receipts.

This case study supports the broader data from our national report DHA Karachi Investment Strategy 2026, outlining where the next wave of returns will come from

💡 12. Long-Term Impact

| Metric | Old House (Pre-2005) | Rebuilt (2025) |

|---|---|---|

| Maintenance | ₨ 1.2M/year | ₨ 350k/year |

| Rent | ₨ 180k/month | ₨ 330k/month |

| Buyer Interest | Low | High |

| Structural Life | 10 years | 25 years |

| ROI | 6–8% | 15–20% |

🧠 Meaning: Every rupee spent on rebuilding multiplies into long-term rental yield and resale credibility.

🏁 Conclusion — Smart Rebuilding Pays Off

This case study proves what hundreds of builders already know:

DHA Phase 6’s old houses are hidden opportunities.

A smart rebuild not only doubles your design appeal — it multiplies your investment.

📲 Get Help from Verified Builders & Engineers

Visit ApnaDHA.com — Pakistan’s DHA Property Portal to connect with verified contractors, architects, and investors shaping the future of Karachi’s real estate.

Join The Discussion